Some have asked will the dollar has previously fallen with higher interest rates so why will the opposite unfold now? The answer to that question is rather important to grasp – YES and NO. Sometimes YES and sometimes higher interest rates reflects a weak currency but NO for higher interest can reflect also a strong currency. Now the perpetual critics will say oh you are zig-zagging so you can have it both ways.

What you have to understand is there is ABSOLUTELY no relationship that is EVER fixed. There will be times rising interest rates will support a currency and at other times they will rise because of capital flight as we have seen in Russia, Greece, Argentina, Brazil etc.. This is a contango within a complex system – not some linear one-dimensional world where people expect a concrete relationship that never changes.

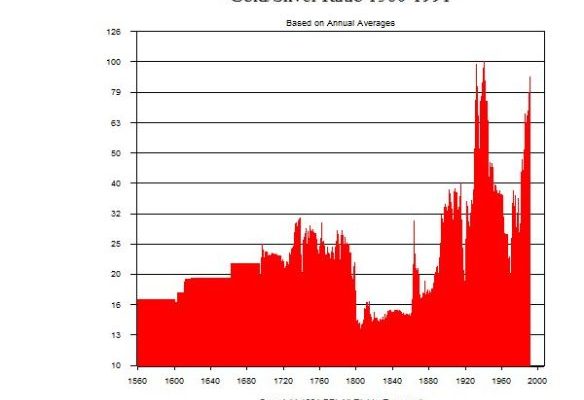

It does not matter what it is, there will NEVER be a constant. Look at the Silver/Gold Ratio. That has been a good one. The promoters always suck people in claiming it should be 16:1 so buy it now and make a fortune. Such nonsense cannot be supported ever for the fact expose it is fictional sales-bullshit. That ratio has been everywhere from 120:1 to 15:1 since 1560. Obviously, there is no constant.

When it comes to currency, we are dealing with a sort of share price based upon the performance of a nation. It becomes a matter of CONFIDENCE which is key. When CONFIDENCE is strong in one country, capital will flee to that currency causing a bubble in assets that a central bank will misunderstand and be compelled to raise rates to try to stop the bubble it thinks is domestic oriented. This will only subsidize foreign investment further. This is how real BUBBLES are produced. On the contrary, rates will also rise when CONFIDENCE collapses as the central bank is trying to support a currency. This will typically fail for they fear lower values and rates must rise enough to exceed the expectations of any decline  We saw this recently with rising rates also in Russia as the Ruble fell.