Managing expectations and emotions with investing is probably one of the hardest things to do on a consistent basis. Let’s face it – in our busy daily lives we have come to expect fast results and instant gratification from the speed of information at our fingertips. I go out of my mind when a website takes more than 5 seconds to load and find myself frustrated when something doesn’t seem to be making any progress.

It’s also easy for those impatient feelings to leak over into our investing endeavors as well. The other day I received an email from a client that went something like this:

Hey Dave,

I made my IRA contribution the other day. How are things going? It seems like growth has been pretty slow lately.

Thanks,

Joe Client

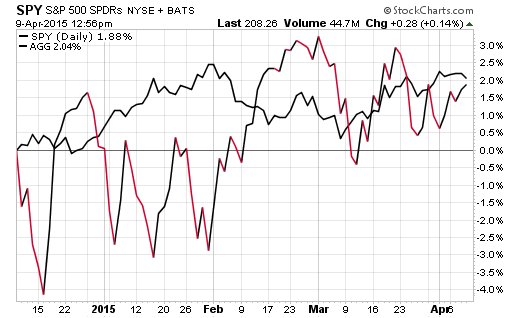

Tough to argue with that line of thinking because he is absolutely correct. It has been incredibly slow out there in the financial markets and gains have been tough to come by. Over the last four months the SPDR S&P 500 ETF (SPY) has gained less than 2%. However, the frequent 1% daily price swings in the major indices have made it seem like we are just rambling sideways with no apparent direction. Depending on what day you look, the market may be up 4% on the year or totally flat.

Â

On the fixed-income side of the ledger, the iShares U.S. Aggregate Bond ETF (AGG) has notched a similar return, albeit with far less overall volatility. On a plain vanilla 50/50 stock and bond portfolio your returns have likely been 2% or less over the last four months. Certainly nothing to be disappointed about, but probably starting to grate on the nerves of those that have come to expect double digit gains like we saw in 2013 and 2014.

Keeping Things In Perspective

One of the most important lessons I have learned over the last decade in this business is that patience and discipline are a far better strategy than feeling like you have to be doing something all the time. The market often experiences long periods of inaction followed by very swift moves. Trying to time every little gyration is going to lead to more frustration and likely far worse performance than sticking with a sensible and balanced solution.