(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 60.6%

T2107 Status: 54.2% (faded back from a breakout)

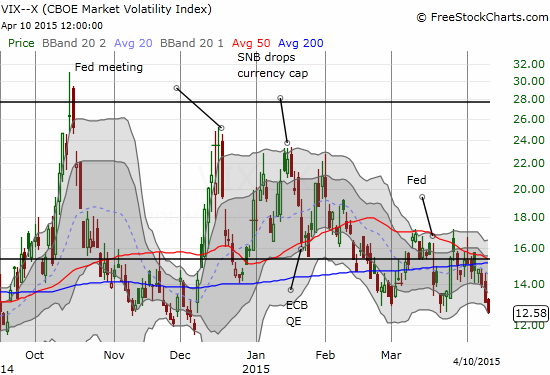

VIX Status: 12.6

General (Short-term) Trading Call: Neutral. Market still seems stuck in a chopfest. T2107 is still showing the potential for an important breakout.

Active T2108 periods: Day #119 over 20%, Day #78 above 30%, Day #22 above 40%, Day #6 over 50%, Day #1 over 60% (overperiod), Day #189 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDSÂ (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEMÂ (iShares MSCI Emerging Markets)

VIXÂ (volatility index)

VXXÂ (iPath S&P 500 VIX Short-Term Futures ETN)

EWGÂ (iShares MSCI Germany Index Fund)

CATÂ (Caterpillar).

Commentary

Earnings season is about to kick-off in earnest and all is as calm as can be. The volatility index, the VIX, closed at levels last seen in December.

Â

No fear ahead of earnings

This lack of fear will make the market particularly vulnerable to negative surprises, but it is of course very possible Mr. Market will refuse to express surprise.

T2108 closed the week at 60.6% and made no progress from Monday’s close. The S&P 500 diverged a bit by managing to build on its gains from Monday’s rally to close over 2100 again.

Â

The S&P 500 is creeping higher again

Now that the S&P 500 has returned to the top of its current chopping range, the risk of the low VIX is further amplified upon negative surprises.