When the Fed hikes rates, some of the most widely held high-yield investments will become more volatile. With that uncertainty looming, income investors should take refuge in these eight low-volatility dividend payers whose businesses will grow in a higher rate environment.

Finding yield hasn’t been easy of late and it’s about to get a lot harder.

The yield on the 10-year U.S. Treasury note (TNX) has been cut in half over the last five years.

And recently, the 10-year Treasury yield dipped below the average dividend yield for the S&P 500 (SPY).

With this, investors have exited bonds in droves, buying up the higher yielding industries in the stock market, namely utilities and real estate investment trusts (REITs).

For 2014, both the Dow Jones U.S. Utilities Index and Dow Jones Equity REIT Index outperformed the Dow Jones Industrial Index (DIA) by more than 15 percentage points.

But with the impending rate hike by the Fed, this is a trend that’s already started to reverse this year and the divergence should only continue.

The case can be made that REITs are still worth owning, but you have to be very selective. Still, the entire industry will take a hit as money managers and mutual funds dump the REIT ETFs, leading to increased volatility in even the best REITs.

Now, the Fed’s rate rise likely won’t be huge. It will be minimal, but the market always tends to overreact. That said, we can decipher which dividend payers might benefit and which might suffer in a higher interest-rate environment.

Let’s start with tech.

The first area of the market to look at is in technology. These companies carry low debt and tend to outperform in periods after a rate increase.

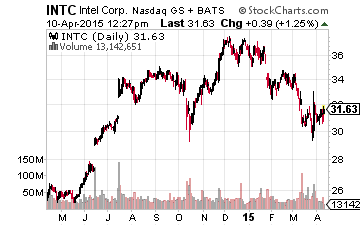

Intel (NASDAQ: INTC)Â is the largest semiconductor company in the world and needs no introduction. It crushes the competition in terms of market share, but the shift away from PCs has cast doubt over the company.

However, it’s still a major player in the server processor business. This part of the market is benefiting from the shift to smartphones and tablets — the move toward mobile computing is increasing the demand for cloud computing which ultimately boosts demand for servers.

Besides the fact that it’s one of the largest players in the tech space, it also has a relatively low-level of debt and a 3.1% dividend yield, which it’s upped for five years in a row.

Another tech idea is Microsoft (NASDAQ: MSFT), which is one of the more negated companies in the tech space. The rise of tablets, which is pressuring personal computer sales, has led much of the market to brand Microsoft as adying tech company.

But with a 3.0% dividend yield and 11 consecutive years of dividend increases, it’s still appetizing to dividend investors.

The truth is that Microsoft has had a number of misfires in the hardware space. The idea is that the tech giant has finally learned its lesson here; read: look for Microsoft to focus on the higher margin software and services business going forward.

This comes as its operating systems, Office suite, cloud business and Windows Server software make up around 80% of the company’s revenues — and nearly all its gross profit. And switching costs for many of Microsoft’s products are high as well.

Now, another area to consider is pharma.

There’s been a lot of talk over a biotech bubble. Despite the fact that we think the notion is overhyped, some investors would still like to avoid the volatility. But healthcare is still interesting, specifically, the big name pharma companies given their low level of volatility. Their betas are as low as 0.2; recall that beta is a measure of volatility — for a stock with a 0.5 beta, if the broader market falls by $1 that stock should theoretically only fall 50 cents.

Tying all this together, with little exposure to interest rate risk, big pharma are great income plays for investors looking for stability in a rising rate environment.

One of the top picks here is Merck & Co. (NYSE: MRK), which is offering a 3.1% dividend yield. Merck has a number of high-margin drugs and a strong pipeline. This is often overlooked as Merck went through a number of patent expirations recently. But the worst is over.

The company has been reducing costs to help mitigate margin erosion due to patent expirations. Its focus now is on large markets like cancer and diabetes. Plus it plans to launch six drugs over the next two years. Its beta is at a comforting 0.34.

Another idea in the pharma space is Bristol-Myers Squibb (NYSE: BMY), which offers a 2.3% dividend yield and has one of the lowest betas in the entire market, at just 0.26. Bristol-Myers will be past its major patent expirations next year and ready to focus on growth prospects.

It recently inked a cardiovascular partnership with Pfizer, which will reduce its risk and lower marketing costs to bring its atrial fibrillation drug to the market. It will also be bringing its cancer drug, Opdivo, to the global stage over the next couple years.

Finally, let’s entertain the bank talk for a minute.

Financials, specifically banks, can be hit or miss. It all depends on how sensitive they are to rates. Some banks have more exposure to short-term interest rates, versus longer-term ones, depending on how they have their deposits and loans structured.

In any case, the idea is that interest rates are generally good for banks. Thus, let’s have a look at a couple ways to play the financials.

BB&T (NYSE: BBT)Â made it through the financial crisis without a quarterly loss. Thanks to its strength after the financial fallout of 2008 and 2009, it has been able to position itself nicely with an aggressive acquisition strategy.

And when thinking about bank costs, one of them is its interest related payouts on deposits. This is something BB&T has been working on mitigating as it’s been on an acquisition spree. Over the last five years, it’s increased its non-interest bearing deposits to 30% of its deposits, up from 20%. This gives the bank a low-cost funding base to make loans and invest in revenue generating businesses.

It also generates fees from its insurance business, which takes out some of its reliance on higher interest rates. Its dividend yield is right at 2.5%.

PNC Financial (NYSE: PNC)Â is another regional bank that should benefit from higher rates. The RBC acquisition from a few years ago gave PNC a Southeastern U.S. presence and doubled its size.

But the real story here is that this bank will do well even if it takes rates a while to move significantly higher. This comes as about 40% of its revenues are generated from non-interest related activities, such as its asset management business.

PNC is paying a 2.2% dividend yield.

As a bonus, investors looking for yield should also consider underrated stocks that consistently up their dividends.

This goes along the lines of investors shifting from the high income plays like REITs and utilities to stocks that have a track record of dividend increases.

Stocks growing their dividends tend to have “stickier†investors, ones that are there because it’s a good company with a reliable dividend. As opposed to being invested just for the high dividend, which is the type of investor that industries like utilities tend to attract. The couple of stocks we’ve found below also have no debt and are generating double digit returns on invested capital.

Raven Industries (NASDAQ: RAVN)Â is an $800 million market cap conglomerate. It has a number of businesses, including manufacturing performance plastic films, GPS products, and radar systems. The stock has really taken it on the chin over the last year or so as it tries to navigate an internal restructuring. The focus is on moving itself away from low-margin segments to the service-focused higher margin businesses.

One of the real appealing parts of Raven isn’t just its attractive valuation and turnaround prospects, but it has 29 years of consecutive dividend increases under its belt. Its dividend yield is 2.5%.

Although it only has five years of dividend increases, Fastenal Company (NASDAQ: FAST) is another interesting dividend grower. Its dividend yield is right at 2.8%. Despite being relatively large, with an $11 billion market cap, it still owns a very small part of the maintenance and repair construction supply market.

This is a market that has treated Fastenal well over the years. Over the last 10 years it has managed to increase sales at an annualized rate of 9%. Taking it to the next level is expected to be the roll out of vending machines.

In the end, predicting when and by how much the Fed will raise rates has been an impossible game over the last couple years. But one thing’s for sure, we’re closer now than ever before, and when rates do rise there will be a selloff in certain industries. Yet investors can still find low volatility yield opportunities that aren’t tied to interest rates.

Finding stocks that are growing their dividends can be one way to protect yourself from the inevitable market pullback from the Fed raising rates. These stocks tend to hold up better and recover quickly.

Â

Â