Earlier today, we reported that Germany is preparing a contingency plan to deal with the fallout from a Greek default, the odds of which analysts are now putting at even money. According to Die Zeit, Berlin is looking at options to keep the Greek banking sector solvent (i.e. make sure there are still euros in the ATMs) even in the event Athens misses a payment to the IMF next month. Germany also indicated it was prepared to let Greece go should Tsipras, Varoufakis, and their merry band of Syriza socialist saviors be unwilling to adopt reforms in exchange for assistance to the banking sector. In the event the Greek government remains steadfast in its “where’s our money†approach to negotiations, Brussels will reportedly assist the country in transitioning back to the drachma.In the midst of the (continuing) drama, UBS is out with a new note which warns against adopting the idea that a Grexit would prove to be an isolated event. Here’s more:

Investors seem to have embraced the belief that if Greece were to walk away from the Euro, it would walk alone with minimum contagion to other countries. This belief is dangerous. UBS does not believe Greece will leave the Euro as our base case scenario. However, if Greece were to depart, there a distinct possibility that other countries would join Greece in exiting the monetary union. This is because of the way contagion is spread in a monetary union breakup, and it could happen within months of a Greek departure…

Â

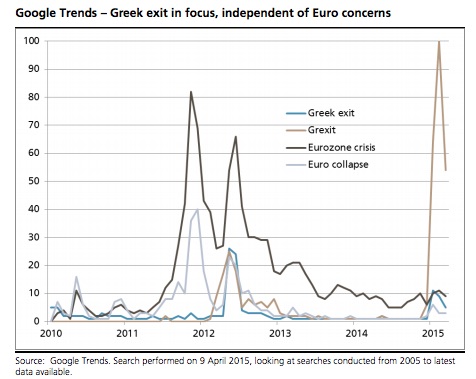

The chart gives some indication of the complacency of markets. Interest in a Greek exit from the Euro (as signified by Google searches for the somewhat irritating portmanteau “Grexit”) recently reached an all-time high, but the relative concern for a wider Euro area problem has seemingly fallen far below the levels of 2011 and 2012.Â

UBS goes on to caution investors against attempting to take anything away from an assessment of eurozone sovereign spreads vis-a-vis GGB yields. The logic is simple: spreads simply don’t mean anything in the face of excessive monetary easing: