Great results from the banks this week sent the Q1 S&P 500 earnings growth rate higher by half of a percentage point. The blended consensus is still negative, with profit growth for the index expected to come in at -1.3%. Revenues are slightly worse at -1.4%.

Of the five big banks that reported this week, four of them, Goldman Sachs (GS), Citigroup (C), Wells Fargo (WFC) and JPMorgan Chase (JPM), beat Estimize expectations on the bottom-line. Only Bank of America (BAC) fell short, and we are still waiting to hear from Morgan stanley (MS) on Monday. On average, the four winning banks surprised to the upside by 17.4%, that’s in comparison to the S&P 500 surprise of 7%. These better-than-expected results have bumped financials into third place among leading sectors with anticipated profit growth of 8.8%, behind health care with 12.7% and consumer discretionary at 12.9%.

How are we doing?

Leaders

Earnings:

Consumer Discretionary (12.9%). Notable industry: Automobiles (54.0%)

Health Care (12.6%). Notable industry: Biotechnology (33.9%).

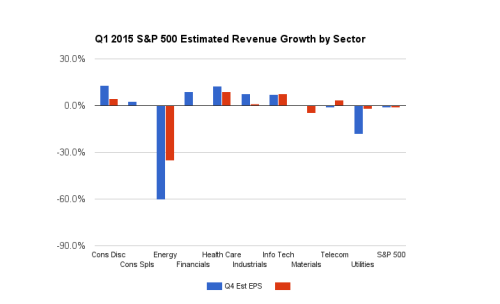

Revenues:

Health Care (8.8%). Notable industry: Biotech (36.2%).

Information Technology (7.7%). Notable industry: Internet Software & Services (25.0%)

Laggards

Earnings:

Energy (-60.4%). Notable industry: Oil, Gas and Consumable Fuels (-65.3%)

Utilities (-18.2%). Notable industry: Gas Utilities (-46.2%)

Revenues:

Energy (-35.4%). Notable industry: Oil, Gas and Consumable Fuels (Â-38.7%).

Materials (-4.8%). Notable industry: Paper & Forest Products (Â-16.3%).

Beat/Miss/Match

Earnings: With 48 S&P 500 companies reporting thus far, 56% have beaten the Estimize consensus, 33% have missed and 11% have met. This is compared to Wall Street estimates, of which 82% of companies have beat on the bottomÂ-line, 4% have missed and 14% have met.

Revenue: 31% have beaten the Estimize consensus, while 69% have missed. For revenues, 45% of companies have beat the Wall Street estimate, while 55% have missed.