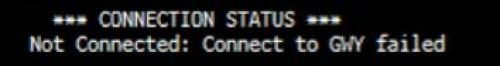

Just as China was closing for trade and Europe was opening, something previously unseen happened: no, not another another GPIF or Virtu inspired market wide stop squeeze, those are quite recurring these days. It was every Bloomberg terminal around the globe getting suddenly disconnected.

This promptly led to widespread panic among traders mostly in Europe, who were flying blind and unable to chat with other, just as clueless colleagues (the one function used predominantly on the terminal is not charts, nor analytics, but plain old chat).

It got so bad that in a world in which everything has become automated, Europe was forced to delay or cancel pricing various bond deals.

As the WSJ observed, the U.K.’s Debt Management announced in a statement Friday morning that it was postponing a scheduled buy-back of government debt â€due to ongoing technical issues with the third party platform supplier,†and that bids already submitted would be declared null and void. A spokesperson confirmed that the supplier is Bloomberg.

In short if the “terrorists” want to take down the financial world, all they have to do is crash the chat system used by global bond traders. As a reminder, equity “traders” speak in nanosecond bursts of binary, and don’t need Bloomberg.

The WSJ continued: “It’s scary how dependent we have become on our Bloomberg screens,†said Anthony Peters, a strategist at London-based capital markets adviser SwissInvest. “We had [bond] deals which are not going ahead due to this,†one London-based banker said, other bankers said that trading volumes had fallen as a result of the outage.

“The communication chat has become vital to the sharing of information across regions and counterparties. So a global outage like this is systemically important to markets all around the world,†said Louis Gargour, the chief investment officer at London-based asset manager LNG Capital, adding that this shows just how vulnerable the market has become.

“We’re flying blind and in our office as our principal counterparties are unable to act as market makers, therefore we’re all catching up on admin because there is little else that we can do,†he added.

A second London-based banker said that even if you wanted to do a bond deal in today’s market, “you couldn’t as communication with possible investors and salespeople is incredibly difficult.â€

A third fixed income banker said that he was involved in a deal but relying on phone conversations for communicating with brokers and investors, which he said feels incredibly “old fashionedâ€.

The outage was trending on Twitter in early European trade and in Asia. Bloomberg said on its website: “We are currently restoring service to those customers who were affected by today’s network issue and are investigating the cause.â€