Once again a rally effort that managed to pull the market within reach of a breakout was quelled as the eleventh hour, putting stocks back in the middle of a recent trading range. This third failure – and potential triple top – is likely discouraging to bulls on the sidelines who were waiting for that one last convincing bullish hint before pouring back in.  What are the key market levels to watch here?

We’ll dissect the market’s current situation, after looking at last week’s and this week’s major economic news.Â

Economic Data

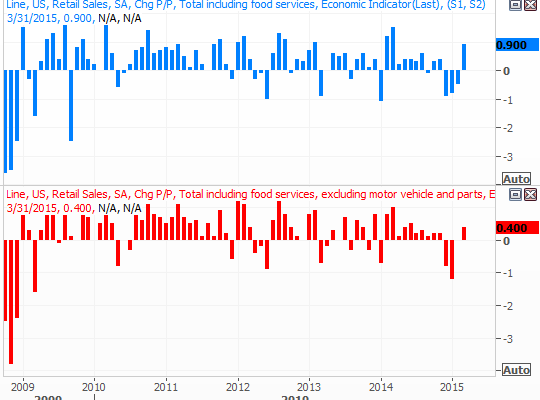

Last week was a busy one for the economy… more data than we can chart or discuss. So, we’ll stick with the highlights beginning with surprisingly strong retail sales figures for March. Though economists were looking for an overall lull and a flat comparison when taking cars out of the equation, retail spending actually grew 0.9% last month and was up 0.4% not counting automobiles. It was a much-needed reversal of three months of negative comps.

Retail Spending, % Change Chart

Source:Â Thomson Reuters Eikon

On a month-to-month basis, prices were a bit higher in March with or without food and energy costs factored in. It’s still a bit soon to say inflation is mustering, however. The year-over-year annualized inflation rates are still slightly negative despite last month’s small upswing.Â

Producer and Consumer Inflation Chart

Source: Â Thomson Reuters Eikon

Anyone hoping the weather-related plunge in housing starts for February would be countered in March was disappointed. The slight uptick from a pace of 908,000 to 926,000 still left the tally at uncharacteristic lows, and while the number of permits didn’t slump as much, there’s a discernible slowdown on that front too.Â

Housing Starts, Building Permits Chart

Source: Â Thomson Reuters Eikon

Though we’ve not got a chart of it, it’s worth noting last month’s decline in industrial production and capacity utilization is becoming something of a trend; both have been weakening since late last year. That’s worth keeping an eye on for the foreseeable future — and those indicators have shown some correlation with the broad stock market performance, as we’ve discussed previously.