For 2014, REITs were one of the hot, hot sectors in the stock market. The REIT indexes and ETFs put up total returns for the year in excess of 30%. In an income-focused sector like REITs, that level of returns is not sustainable. If you own some REIT shares, you know firsthand that the market is now correcting and has been pretty rough on share prices over the last couple of months. But, that is not bad news at all. In fact, now is a great time to buy a quality dividend growth stock like the one I reveal here.

From a mathematical point of view, the hypothetical total return from a dividend-centric investment is the current yield plus the dividend growth rate. For the equity REITs (those that own commercial properties), the overall average yield and growth rates are 3.5% and 10%. So over the years, simple addition shows REIT investors should expect 12% to 15% average annual total returns. Actual returns may swing high above or significantly below this number, but over a period of years, if the yield stays relatively constant the average annual total return must average out to that yield plus dividend growth number.

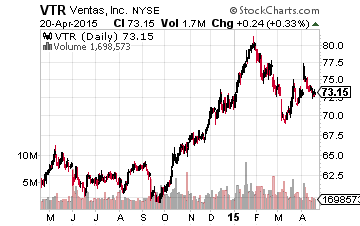

As an example, in June 2014 I added Ventas, Inc. (NYSE: VTR) as a recommended holding in The Dividend Hunter portfolio. Ventas is the cream of the crop out of the healthcare REITs. When VTR was added to the recommendations list at $66.80 per share, the dividend yield was 4.4% with a steady history of 9% dividend growth. I viewed this as a nice combination from a very high-quality REIT for the yield and growth-focused strategy of The Dividend Hunter. However, by late January 2015, VTR had climbed 20% to over $80, running well ahead of the dividend growth rate and pushing the yield down well below 4%.

At that point, I recommended the sale of VTR shares and that subscribers take those gains and reinvest into another quality dividend stock with a higher current yield. The timing was pretty good, with a close-out price of $79.80 and currently VTR is trading at about $73. I am watching company results and the share price to possibly recommend VTR once again to my subscribers.