Those who claim there will be no Greece contagion need consider yields in other European bonds.

In spite of the fact the ECB is buying 60 billion euros of debt a month for 19 months, yields on many longer-dated bonds are rising.

Spain 10-Year Yield

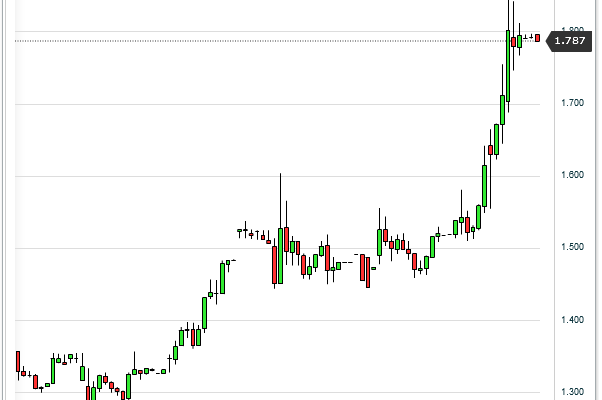

Italy 10-Year Yield

Germany 10-Year Yield

Contagion Already?

Saxo Bank chief economist Steen Jakobsen sees contagion risk in bond yield breakouts.

Via email …Â

A quick note as there has been a number of “break-outs†and risk warnings activated.

First, and most important.

I have long argued that Italian 2 yr vs. 10 yr is excellent predictor of contagion on Greece, and sure enough we have had massive spike!

2-10 if reflecting much higher short-end risk (higher yield) Italy because with France only countries who has done nothing to reign in fiscal deficit plus CLUB MED members.

Contagion or Something Else?

10-year bond yields are up. So are 2-10 spreads. And it isn’t just Italy.

But is the reason contagion risk or erroneous belief that a eurozone recovery is underway? What about the chance the ECB has lost control?

- ECB has lost control

- Contagion

- Recovery

Which is it?

Presuming this trend lasts, this will not be good for equities no matter the reason. But really look out if the reason is #1 or #2.

Mike “Mish” Shedlock

Â