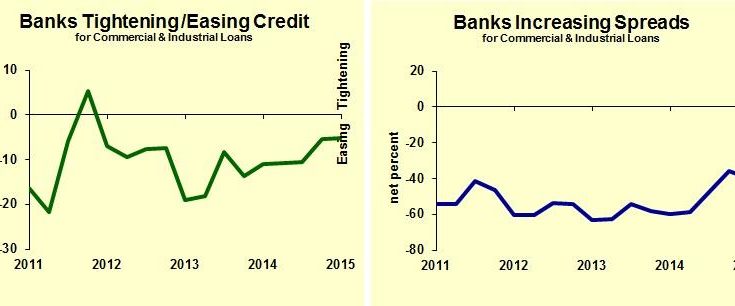

Bank credit for business is getting easier and cheaper, according to the Federal Reserve’s latest Senior Loan Officer Opinion Survey. Banks are easing their credit standards while reducing the interest cost relative to the banks’ costs of funds. The message for businesses: this is the time to bargain.

The survey does not tell us how much banks are easing credit standards, simply how many are easing and how many are tightening. The data are presented as the net number tightening. When it’s positive, as it has been recently, more banks are easing than tightening. The gap looks small, but banks don’t like to report that they are easing credit; much more often they report tightening. So even a report of a small amount of easing is significant.

Banks are hungry for good borrowers. The ratio of loans to deposits is just 76 percent, with 86 percent average, and the past peak at 104 percent. The deposits that are not lent out earn the banks just one quarter of one percent, at least until the Federal Reserve raises interest rates.

Businesses that have not qualified for bank debt should talk to a banker now. Even if the company does not need a loan, it might be worthwhile to have a line of credit for unforeseen opportunities.

Companies that already have bank debt should think about renegotiating the terms of the loans. Perhaps the bank will come down on interest rate or ease the loan terms, such as releasing the company’s owner from a personal guarantee.