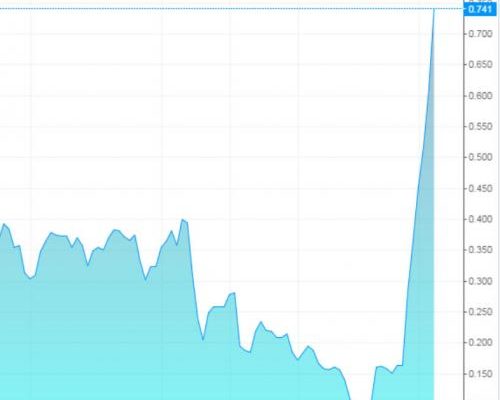

To get a sense of why futures are sliding right now, and what every global trader of any asset class is looking at right this moment, look no further than the chart below which shows what is going on with German Bunds yields.

Â

As DB and Reuters conveniently point out, this is the biggest and fastest weekly drop in Bund history.

Bund future -450 ticks this week (-700 in last two weeks), biggest fall since German reunification: pic.twitter.com/jLvcDDeZhy

— Jamie McGeever (@ReutersJamie) May 7, 2015

The catalyst for today’s plunge was weak French OAT auction, which saw yields rise and bid/cover ratios decline at 2023 and 2025 bond actions. “The big fallout in core fixed income occurred after a very soft French auction with a large tail which collapsed the market again,” according ED&F Man head of U.S. rates Tom Di Galoma writes in note. But while there was an immediate cause, what really happened was a continuation of the selling momentum seen in the past two weeks.

Now it is no secret that three weeks ago when the Bund was on the verge of sliding under 0.00%, the ECB wanted nothing more than to have a controlled selloff because at this rate of “frontrunning” Draghi’s purchases, the central bank would soon be left with nothing to monetize above its -0.20% deposit rate hard limit.

However, the epic rout it has since gotten following some serious public and private sector jawboning, is precisely the opposite of what the ECB wanted which needed a smooth, controlled descent, and the sheer speed and size of the selloff is why Draghi may have no choice but to step in soon with some verbal intervention and declare that Bund yields, which are now well above where they were when Q€ started, will be pushed lower “whatever it takes.”

For now however, this is what is going on:

- BOND SELLOFF DEEPENS; GERMAN 10-YR YIELD JUMPS 17 BPS TO 0.76%Â

- SPANISH 10-YEAR BOND YIELD CLIMBS TO 2%; HIGHEST SINCE NOV. 24

- ITALIAN 10-YEAR BOND YIELD CLIMBS ABOVE 2%; 1ST TIME THIS YEAR

- 10Y TREASURY YIELD CLIMBS 6BPS TO 2.31%, HIGHEST SINCE DEC. 8

- U.K. 10-YR BOND YIELD CLIMBS 8 BPS TO 2.06%; MOST SINCE NOV. 24

- IRISH 10-YEAR YIELD RISES ABOVE 1.5%, FIRST TIME SINCE NOV. 21

- JAPAN 10Y YIELD UP 7.5 BPS, SET FOR BIGGEST RISE SINCE MAY 2013

- INDIA’S 2024 BOND YIELD CLIMBS 9 BPS TO 7.98%

As a result of the ongoing bond drubbing, European equities have started the session on the backfoot in tandem with the lacklustre Wall St. close in the wake of the disappointing ADP report yesterday which has dampened expectations for Friday’s NFP reading. Furthermore, stocks in the US were also weighed on yesterday by comments from Fed Chair Yellen who said that she viewed the stock markets as ‘generally quite high’. Additionally, Asian equities traded lower across the board overnight with particular undperformance in Chinese equities amid ongoing margin trading crackdowns. Given the recent trend in European yields, which has seen the German 10yr break above 0.75%, higher borrowing costs have also weighed on European companies. Furthermore, European equities have also been subject to a slew of pre-market earnings which have provided some reprieve for the DAX.

In fixed income markets, Bunds have once again continued to ebb lower with the German 10yr yield breaking above its 200DMA seen at 0.635% to break above the 0.75% level. This week has seen the biggest rise in the German 10yr yield since 25yrs with Bund yields currently on track for their largest intra-day rise since mid-2012. This comes amid no new fundamental newsflow and is more of just an extension of the recent trend but the FT highlight that the recent pullback in energy prices could weigh further on fixed income products due to inflation expectations.