As regular readers are no doubt aware, the persistent bid under the US equity market during Q1 came courtesy of price insensitive corporate managment teams who, in a rush to take advantage of rock-bottom borrowing costs just in case the Fed decides to go crazy and actually raise rates later this year, have issued a record amount of debt and plowed the proceeds back into their own shares, artificially inflating the bottom line and boosting their own equity-linked compensation in the process.

As we noted earlier today, repurchase authorizations hit a record $141 billion last month, providing investors (and the SNB) with an excellent opportunity to front run corporate buybacks and giving the centrally-planned, 6-year rally one more excuse to continue for a few more months.Â

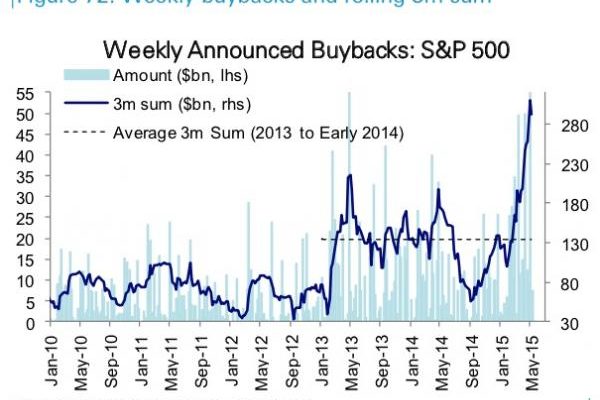

With that said, we present the following chart from Deutsche Bank (DB) which explains just how it is that US stocks are near record levels even in the absence of a bid from households and institutions.

* Â * Â *

Bonus chart: