Headline risk surrounding Greece will likely weigh heavily on investors’ minds throughout the week as Syriza faces one of its biggest tests yet when a €750 million payment to the IMF comes due on Tuesday. Despite rampant skepticism and a warning from Germany’s Schaeuble that countries can “accidentally†become insolvent, FinMin Varoufakis claims Greece will make the payment and thus avert an imminent default. This comes as finance ministers from across the currency bloc meet to discuss Greece’s future with the consensus being that there almost certainly will be no definitive deal on Monday, but there look to be conflicting reports as to whether an interim solution to address the country’s immediate liquidity needs can be fashioned.Â

Via Reuters:

A 750 million euro debt repayment to the IMF falls due on Tuesday but Varoufakis said a deal that would provide some liquidity relief for Greece was more likely in the coming days…

Euro zone officials have ruled out a deal with Greece at Monday’s meeting and said any statement they make is unlikely to be enough to allow the European Central Bank to raise the limit on short-term Treasury bills that Greek banks can buy – a move Athens has sought as a way to avert a national bankruptcy.

In a sign of growing pressures within the ruling Syriza party against backing down to lenders, the parliament speaker Nikos Filis suggested on Monday that the IMF debt repayment would depend on the Eurogroup outcome…

The stance of Filis, a hardliner within Syriza, is different from that of the government, which says it will make the payment on Tuesday.

“It is clear that any move by one side affects the other side. The next moves will be shaped by today’s developments, we are seeking an agreement,” Filis told Mega TV.

“The decision (on the IMF repayment) will be taken today. It depends on the Eurogroup,” he said.Â

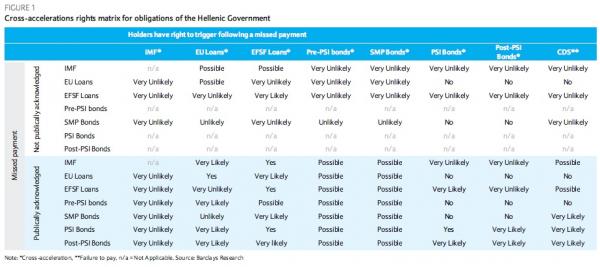

Regardless of whether some stopgap measure is found for tomorrow’s IMF payment, Athens faces five more payments to the IMF over the course of the next two months, and given the seemingly intractable character of the negotiations, it’s worth considering what happens in the event of an “accidentâ€. Barclays has taken a look at the country’s liability stack to determine where there is potential for cross-acceleration of payment rights.

In other words: assuming Greece defaults on an obligation to a given creditor, what are the implications for other creditors in terms of their right to demand immediate payment? Below is a matrix which outlines the universe of possibilities.

Â

For their part, UBS is out with “four scenarios for Greece and the Eurozone.†Here’s more:

Scenario 1: Eventually positive outcome, default and Grexit avoided Under this scenario, the negotiations between Greece and the Troika remain protracted, but they will eventually make sufficient progress for the Troika to sign off the conclusion of the stalled fifth review. This would lead to the payout of €7.2bn, but parts of the disbursement (for example the ECB’s €1.9bn in SMP profits on Greek bonds) might be paid out earlier (for example, after reformrelated legislation had been passed by the Greek parliament) in order to help the Greek government to avoid a default in May/June…

The key to a breakthrough would be that the Greek government, amid increasingly precarious public finances and ongoing deposit outflows from the banking sector, would eventually be forced to make more comprehensive concessions in crucial areas of structural reform, such as pension and labour market reform, taxation, and privatisation – measures that would go against vested interests in Greece. In return, to soften the political resistance to these measures and allow for somewhat greater social spending, the Troika would allow the Syriza government to run a lower than previously targeted primary surplus…

Scenario 2:Â Default, but no Grexit Under this scenario, negotiations would continue to proceed very slowly, with the Syriza government remaining reluctant to give in to Troika demands related to unpopular structural reforms and fiscal targets. Amid an increasingly difficult budget situation, the government’s ability to service its debt while at the same time paying wages and pensions would decline further and the government would eventually default on (parts of) its debt.4 In the event of a default, the risk of Grexit would clearly rise, but it would not be inevitable. In our view, it would depend crucially on:Â

- what sort of debt the government would default on;Â

- whether this would trigger cross-default on other debt;Â

- how the default would affect the stability of the Greek banking system;Â

- how the ECB would react to a default; andÂ

- how long the default would last