There is hardly a better signal that inflection points in asset classes have been reached than major shifts in capital in/outflows. As a reminder, Bank of America has practically made a career of dragging out the old “great rotation” canard every time there has been a, well, great rotation, out of bonds and into stocks for the past 4 years… only to always top (and bottom) tick said capital flows. Overnight it did it again, when it reported that based on EPFR data, bond funds just suffered the biggest weekly outflow in 2 years of some $10.3 billion matched by a $10.8 billion inflow into stock funds: the largest since March.

Â

As BofA frames it: “this is the 4th biggest bond-to-equity rotation in 6 years.”

Â

BofA shows the following chart to suggest that bond flows simply track the Fed’s balance sheet.

Â

Well they do of course, because all that excess created money has to go, and be rehypothecated somewhere. What BofA did not show is the chart showing the level of the S&P vs the Fed’s balance sheet. For obvious reason.

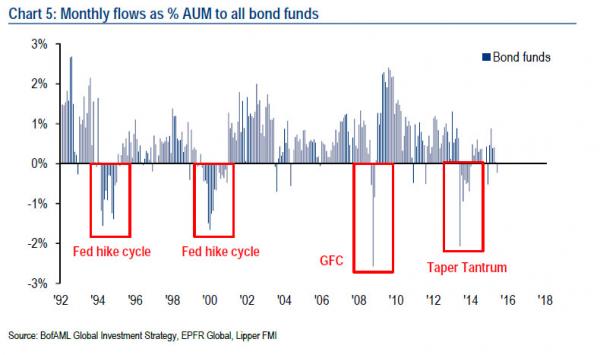

So how to know that the bond outflows are over? Simple: BofA gets giddy about the “bond carnage”,which it says is “evident in first IG redemptions in 78 weeks ($2.1bn), longest govt bond outflow streak since Oct’13, biggest HY outflows since Dec’14 ($4.0bn).” The driver for said rush for the exits, per BofA, are fears “in the past 2 weeks (in order of worry) on Market Liquidity, Fed, Greece.”

Some more from BofA’s Michael Hartnett:

Bond mania past 6-years of QE (Chart 1), Fed exit, poor market liquidity raising fear of bond redemptions cycle (Chart 5). Note since 2009, $1.2 trillion inflows to bond funds vs $573bn inflows to equity funds; over same period net equity inflows = just 6% of AUM vs staggering 66% of AUM for bond fund inflows (Chart 2).

Curiously, nobody appears to have explained to retail that if bonds are overvalued (which they are) and in a bubble, then the resultant price collapse will crush equities which are just as, if not more overvalued (they are), as rising rates will leads to soaring interest expense and tumbling profits, a collapse in already scarce balance sheet liquidity, which will force companies to raise capital the old-fashioned way: by selling equity.