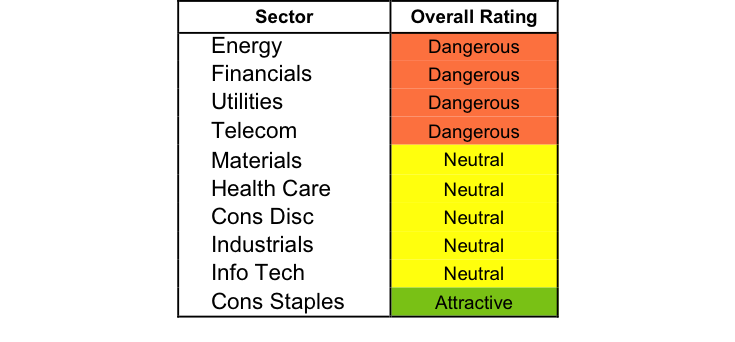

At the beginning of the third quarter of 2015, only the Consumer staples sector earns an Attractive-or-better rating. Our sector ratings are based on the aggregation of our fund ratings for every ETF and mutual fund in each sector.

Investors looking for sector funds that hold quality stocks should look no further than the Consumer Staples and Information Technology sector. These sectors house the most Attractive-or-better rated funds. Figures 4 through 7 provide more details. The primary driver behind an Attractive fund rating is good portfolio management, or good stock picking, with low total annual costs.

Attractive-or-better ratings do not always correlate with Attractive-or-better total annual costs. This fact underscores that (1) cheap funds can dupe investors and (2) investors should invest only in funds with good stocks and low fees.

See Figures 4 through 13 for a detailed breakdown of ratings distributions by sector. See our ETF & mutual fund screener for rankings, ratings and reports on 7000+ mutual funds and 400+ ETFs. Our fund rating methodology is detailed here.

All of our reports on the best & worst ETFs and mutual funds in every sector are available here.

Figure 1: Ratings For All Sectors

Source: New Constructs, LLC and company filings

To earn an Attractive-or-better Predictive Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only the top 30% of all ETFs and mutual funds earn our Attractive or better ratings.

Fidelity Select Consumer Staples Portfolio (FDFAX) is the top rated Consumer Staples mutual fund. It gets our Very Attractive rating by allocating over 38% of its value to Attractive-or-better-rated stocks.

PepsiCo Inc. (PEP: $95/share) is one of our favorite stocks held by FDFAX and earns our Attractive rating. Over the last decade, PepsiCo has grown its after-tax profits (NOPAT) by 6% compounded annually. The company currently earns a healthy return on invested capital (ROIC) of 10%. Furthermore, PepsiCo has consistently generated positive economic earnings in every year of our model, which dates back to 1998. At its current price of $95/share, PEP has a price to economic book value (PEBV) of 1.2. This ratio implies that the market expects NOPAT growth of only 20% for the remainder of PepsiCo’s corporate life. These are low expectations considering that the company grew profits by 6% compounded annually for the past ten years. If Pepsi can continue to grow NOPAT by 6% compounded annually for the next decade, the stock is worth $127/share- a 34% upside from current valuations.