Greek Citizens Vote “No” on a Bailout Offer that no Longer Exists

An exercise in futility has just ended in Greece, with its population voting down an offer that has expired almost a week ago already. Given the futility of the referendum, its outcome was actually irrelevant from a formal perspective – once the verdict was in, Greece and its creditors would be exactly back where they were half a year ago already: at square one.

In one sense the referendum’s outcome was of course not futile: It has solidified the current Greek political leadership’s grip on power. It merely hasn’t brought it any closer to a solution. Greek voters want Greece to retain the euro, but they cannot vote on how much money governments (or rather, taxpayers) of other countries should hand to Greece or under what conditions. They can also not vote on whether the ECB should resume lending to technically insolvent banks.

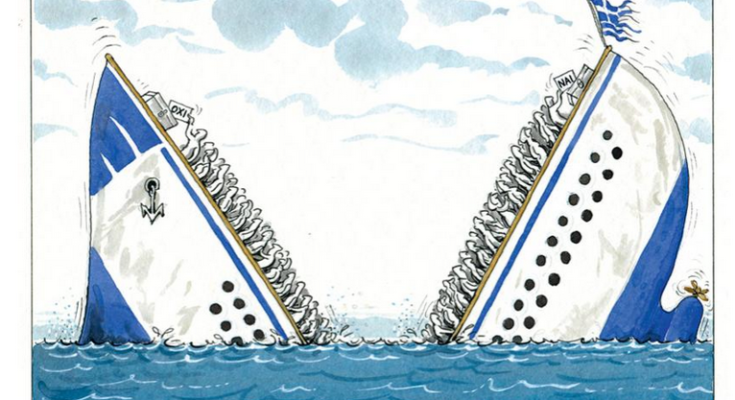

Futile exercise

Cartoon by Ilias Makri

There are of course powerful reasons why the EU is indeed interested in implementing another can-kicking agreement. For instance, as Carl Weinberg has pointed out in Barron’s, a Greek default is a very costly affair, as what were hitherto contingent liabilities will have to be reflected in government budgets:

“Greece is on the verge of defaulting on 490 billion euros ($540 billion) in loans, bond obligations, central-bank liquidity assistance, and interbank balances. Who will bear those losses? Greece’s creditors, which are all public entities across the euro zone, and that are on the hook for some €335 billion in loan guarantees. How will those losses be covered? Bonds will have to be sold that will roughly equal the increase in annual debt purchases by the European Central Bank announced last January.

[….]

Consider the ESM, Greece’s biggest creditor. Under its previous name, the European Financial Stability Facility, it loaned Greece €145 billion. If Greece defaults, the ESM, a Luxembourg corporation owned by the 19 European Monetary Union governments, will have to declare loans to Greece as nonperforming within 120 days. Accounting rules and regulators insist that financial institutions write off nonperforming assets in full, charging losses against reserves and hitting capital.

Here’s the rub: The ESM has no loan-loss contingency reserves. Its only assets—other than loans to Greece—are loans to Ireland and Portugal. Its liabilities are triple A-rated bonds sold to the public. How do you get a triple-A rating on a bond backed entirely by loans to junk-rated sovereign borrowers? Well, the governments guarantee the bonds, and because they are unfunded off-balance-sheet liabilities, they aren’t counted in their debt burdens—unless borrowers default.

If Greece defaults hard, governments will be on the hook for €145 billion in guarantees on those loans to the ESM. We expect credit-rating agencies to insist that these unfunded guarantees be funded. After all, unfunded guarantees are worthless guarantees.

[…]

A hard default would produce other losses to be covered. The ECB would have to be recapitalized after it writes off the €89 billion it has loaned the Greek banks to keep them liquid. The ECB would need to call for a capital contribution from its shareholders—the governments.

And don’t forget that Greek banks owe the Target2 bank clearinghouse, a key link in the interbank payment system, an estimated €100 billion. The governments are on the hook to make good that shortfall, too. The cash required to cover these contingencies would have to be funded with new bond sales.”