Make no mistake, the bevy of measures put forth by Chinese authorities in an effort to stop a three-week slide in the country’s equity markets collectively trump the QE programs implemented by most DM central banks.

Â

Even if one wanted to argue that the PBoC’s support for CSFC doesn’t amount to outright QE (much as some, Morgan Stanley for instance, claim the LTROs associated with the country’s local debt swap program aren’t effectively QE), “quantitative easing†will never be able to compete with “qualitative arresting†in terms of government heavy-handedness in the financial markets.Â

All jokes aside though, if the reprieve Chinese stocks have received from Beijing’s crack down on “rumor spreaders,†“hostile†foreign short sellers, and just plain old “sellers†fades starting on Monday (which we suspect it might), the Politburo may indeed be forced to abandon all pretenses that the PBoC isn’t directly monetizing stocks. In other words, China may have to abandon the “there’s no such thing as Chinese QE†line once and for all. With that in mind, consider the following from Credit Suisse, who has more on China’s “Draghi†moment.

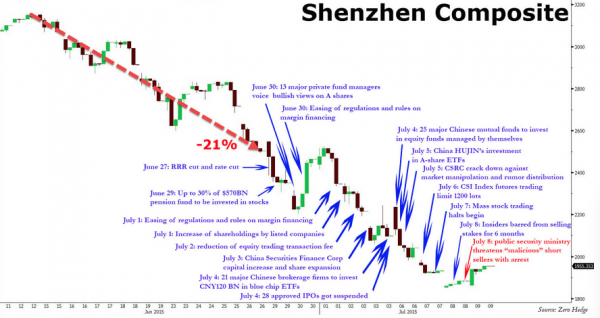

First, Credit Suisse takes inventory of the extraordinary lengths China has gone to to stop the bleeding.

When a central bank says “whatever it takesâ€, we think the market should listen. The US Federal Reserve did so in 2008 and the European Central Bank did so in 2012. Is it the People’s Bank of China’s turn now?

The equity market panic has continued, with the Shanghai Composite Index diving by 32% over the past four weeks and share prices of smaller companies dropping even more. The authorities have launched two rounds of confidence-boosting measures over the past two weekends, neither meeting with much success.

The first round of confidence-boosting measures, anchored by cuts in interest rates and stamp duty, failed dramatically, as conventional policies had little impact in stopping the mechanical unwinding of leveraged positions. Over the past weekend, Beijing switched to administrative intervention by banning short selling and suspending IPO processes. State-controlled pension funds and sovereign funds are buying large caps, in an attempt to boost the index. More extraordinarily, the central bank injected liquidity in to the China Securities Finance Corporation Limited (CSFC) to buy stocks, without any pre-set limit in amount or timeline. Still, the measures did not seem enough to stop the market deleveraging and spiraling downward.