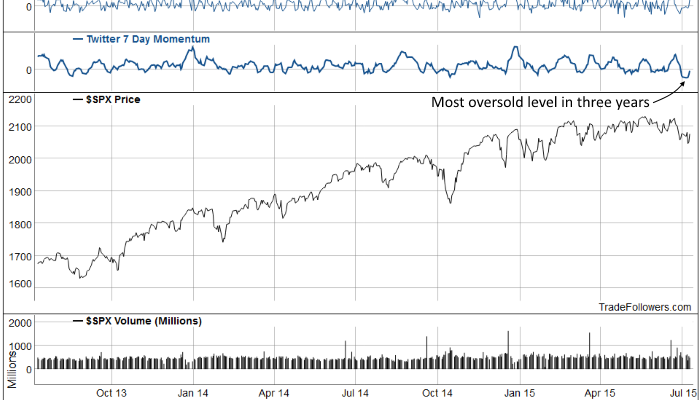

I’m starting to see signs that market participants on Twitter are turning from bullish to neutral. This is the first sign of longer term weakness from the Twitter stream that I’ve seen since mid to late 2012. Before the strong rally that started in late 2012 it was common for 7 day momentum to stay below zero for extended periods of time as traders were accustom to periodic corrections. The lack of a decline greater than 10% since then has kept 7 day momentum mostly above zero with a few small dips that quickly reverse higher. It seems that we’ve all been conditioned to buy the dip.

Â

The weakness over the past two weeks in the S&P 500 Index (SPX) has caused 7 day momentum and sentiment to dip to the lowest level in nearly three years. It appears that the combination of Greece and China is having an impact on longer term sentiment. I’m not seeing outright bearishness yet, but it does appear that there is a shift from bullishness to neutral on Twitter finance.

Breadth between the most bullish stocks and the most bearish stocks is showing signs neutrality as well. Over the past several weeks the number of bullish stocks has been declining, but the number of bearish stocks isn’t rising rapidly. This indicates that investors are getting cautious by taking profit from their winners, but not getting extremely bearish about their losers. The lack of bearish stocks is keeping breadth above both the January and October lows.

Â

As I mentioned at Downside Hedge, half the stocks in the S&P 500 index are below their 200 day moving average. This condition causes risk to rise, but probably won’t cause a steep sell off unless investors get more bearish about their losers. Many stocks are suffering decent sized corrections, but people aren’t tweeting their angst in large volume for the stocks they own. You can keep track of the number of bearish stocks with this interactive chart.

Â