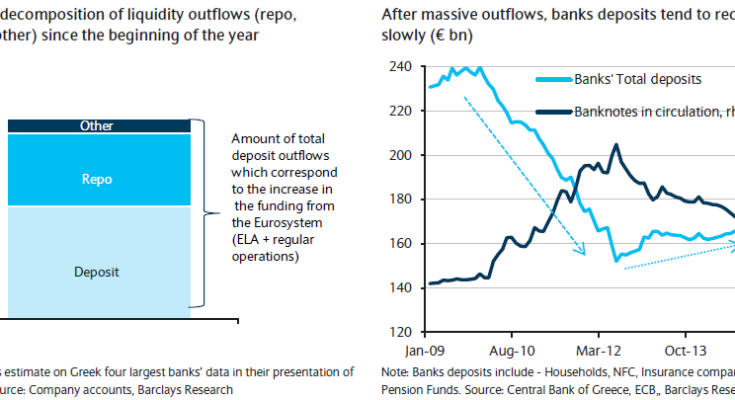

Right now the big question is whether Greece will accept the harsh terms set by the Eurogroup to avoid Grexit, but even if there is a third bailout it doesn’t mean that capital controls will be lifted anytime soon. Greek banks, while still solvent, have lost a quarter of their deposits since last December and now have such a small liquidity buffer that even with ECB support they may not be able to risk another round of deposit withdraws.

“While the current collateral buffer (which we estimate at around €15bn) should allow Greek banks to keep operating if the ECB’s Governing Council approves a further increase in the ELA, we think it will not be enough to absorb any significant increase in deposit outflows in the event that capital controls are eased and banks are reopened,†write Barclays PLC (NYSE:BCS) (LON:BARC) analysts Antonio Garcia Pascual, Christy Hajiloizou and Giuseppe Maraffino.

Â

Greek banks are solvent, but deteriorating

The reason is that deposits flow back in a lot more slowly than they flow out as it takes time for depositors to regain trust in the system. After months of being jerked around, following the disastrous five years of austerity and another debt crisis before that, trust won’t be in great supply regardless of what policy initiatives are put into place. Anyone with large deposits will remember the haircuts in Cyprus, where at one point even secured deposits were up for grabs.

Â

Even though Greek banks look solvent right now, their common equity tier 1 (CET1) capital ratios have declined steadily since the end of last year and are clearly even worse in 2Q though Barclays doesn’t yet have firm numbers. At the same time, non-performing loans are extremely high, reaching nearly 50% at Piraeus.

We already see some collateral management going on, such as the cancellation of retained covered bonds because the pool of loans backing those bonds are higher quality collateral. That it makes a small difference in their overall collateral shows how tight the situation has become.