The preposterous Gong Show in Brussels over the weekend was the financial “Ben Tre” moment for the Euro and ECB. That is, it was the moment when the Germans—–imitating the American military on that ghastly morning in February 1968——set fire to the Eurozone in order to save it.

Some day history will judge good riddance……..but that get’s ahead of the story.

According to an American soldier’s first hand recollection of the Vietnam event, it was a Major Booris who infamously told reporter Peter Arnett, “It became necessary to destroy the town to save it”.Â

After the massacre of Greek democracy in the wee hours Monday morning, Angela Merkel said the same thing—even if her language was a tad less graphic:

It reflects the basic principles which we’ve followed in rescuing the euro. It now hinges on step-by-step implementation of what we agreed tonight.”

Now no one in their right mind could think that lending another $96 billion to an utterly bankrupt country makes any sense whatsoever. After all, the Greek economy has shrunk by 30% since 2008 and is wreathing under what is objectively a $400 billion public debt already in place today.

That figure follows from the fact that on top of Greece’s acknowledged $360 billion of general government debt there’s at least another $25 billion loan embedded in the ELA advances to the Greek banking system. The latter is deeply insolvent, meaning that some considerable portion of the $100 billion ELA currently outstanding is not an advance against good collateral in any plausible banking sense of the word, but merely a backdoor fiscal transfer from the ECB to keep Greece’s financial shipwreck afloat.

Likewise, as I demonstrated Friday, given the even deeper deep hole into which the Greek economy has tumbled during the last six months, the fiscal targets extracted from Greece under this weekend’s demarche are utterly ridiculous. Indeed, even if the targeted primary surpluses of 1,2,3 and 3.5% of GDP are miraculously reached through 2018, upwards of $15 billion of budget deficits after interest accruals would be incurred anyway, and a lot more than that if there are material budget shortfalls, which is a virtual certainty.

So even before the latest dose of Troika economic punishment further debilitates its economy, Greece at this very moment has a de facto public debt of $400 billion sitting atop $200 billion of GDP.

Here’s the bottom line. Merkel has no better answer for how dropping $96 billion of new debt on a country with a 200% public debt ratio will save the euro than did Major Booris when he dropped approximately 10,000 gallons of napalm on Ben Tre in order to “save†the town. In both cases, a doomsday machine had been set in motion, and the designated officers of the state mechanically and blindly carried out a mindlessly destructive next step.

In the instant case, the doomsday machine is the Euro and, more precisely the rogue central bank in Frankfurt that stands behind it. In fact, the real ill is not a common currency per se—-something that Europe actually had on a de facto basis before 1914 under the fixed exchange rates of the gold standard. The latter, in effect, was a common currency because French francs, British sterling, Dutch guilders and the rest were interchangeable at a constant rate—-an arrangement which helped produce a multi-decade spurt of prosperity that the old continent has not seen before or since.

No, the problem is the rampaging printing press of the ECB. The latter has fundamentally falsified the price of debt, and thereby unleashed throughout Europe a deadly brew of phony economic growth in the early years and then egregious fiscal profligacy when the growth bubble cratered after the 2008 crisis.

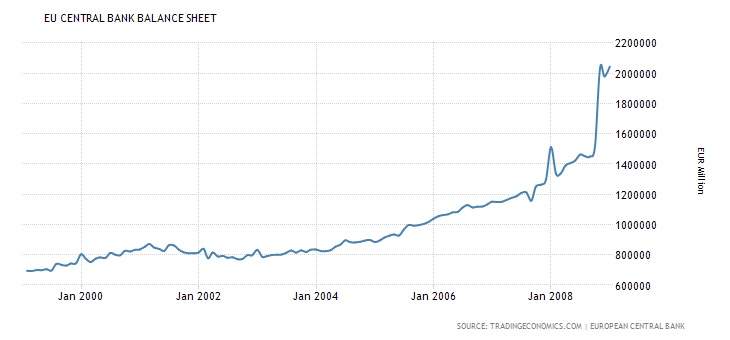

During its initial eight years, the ECB expanded its balance sheet at a torrid14% annual rate. And that’s ironic because the original remit of the ECB was a Friedmanesque “price stability†single mandate.

That didn’t happen, of course, as the European consumer price level rose by 21% during the same eight years (2.4% per annum) in which the ECB’s printing press was running red hot. Uncle Milton would have been rolling in his grave, and, in fact, beforehand had pronounced the euro a disaster waiting to happen.

So rather than delivering consumer price stability, what the ECB actually did during that period was to create a giant artificial bid for euro debt, thereby driven the yields far below their true economic levels. That is, the ECB deeply subsidized newly issued Eurozone government borrowings.

Not surprisingly, Greece, Portugal, Spain, Italy and even France feasted heartily. But then Europe’s phony credit fueled growth stopped, causing the nominal GDP growth rate to decelerate sharply.

Since the eve of the financial crisis, nominal GDP in the Eurozone has crawled forward at a mere 0.9% annual rate. That represents a 75% reduction from the pre-2008 rate and is a reflection of the crushing burden of debt, taxes and the dirigisme of the Brussels superstate and national policies alike.

Accordingly, it quickly became evident that Europe was swimming naked as a fiscal matter, and that the ECB’s cheap money regime had eviscerated the 60% debt-to-GDP target of the EU treaty. Even after averaging in the fiscal rectitude of Germany and some of its northern compatriots, the EU-19 debt ratio has climbed steadily toward the 100% of GDP mark since the financial crisis.