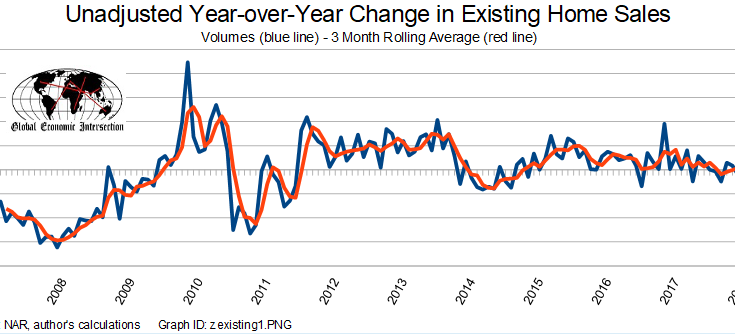

The headlines for existing home sales claim “Buyers have come back in force, leading to the strongest past two months in sales since early 2007“. Our analysis of the unadjusted data shows that home sales did rebound – but that the rolling averages did not improve. Overall, existing home sales appear to continue in the long term improvement trend channel.

Econintersect Analysis:

- Unadjusted sales rate of growth accelerated 8.6% month-over-month, up 13.2% year-over-year – sales growth rate trend is statistically unchanged using the 3 month moving average.

- Unadjusted price rate of growth unchanged month-over-month, up 4.6% year-over-year – price growth rate trend is modestly improving using the 3 month moving average.

- The homes for sale inventory was statistically unchanged this month, remains historically low for Junes, and is statistically unchanged from inventory levels one year ago).

NAR reported:

- Sales up 3.2% month-over-month, up 9.6% year-over-year.

- Prices up 6.5% year-over-year

- The market expected annualized sales volumes of 5.30 to 5.46 million (consensus 5.40) vs the 5.49 million reported.

Unadjusted Year-over-Year Change in Existing Home Sales Volumes (blue line) – 3 Month Rolling Average (red line)

z existing1.PNG

The graph below presents unadjusted home sales volumes.

Unadjusted Monthly Home Sales Volumes

z existing2.PNG

Here are the headline words from the NAR analysts:

Lawrence Yun, NAR chief economist, says backed by June’s solid gain in closings, this year’s spring buying season has been the strongest since the downturn. “Buyers have come back in force, leading to the strongest past two months in sales since early 2007,” he said. “This wave of demand is being fueled by a year-plus of steady job growth and an improving economy that’s giving more households the financial wherewithal and incentive to buy.”

Adds Yun, “June sales were also likely propelled by the spring’s initial phase of rising mortgage rates, which usually prods some prospective buyers to buy now rather than wait until later when borrowing costs could be higher.”

“Limited inventory amidst strong demand continues to push home prices higher, leading to declining affordability for prospective buyers,” said Yun. “Local officials in recent years have rightly authorized permits for new apartment construction, but more needs to be done for condominiums and single-family homes.”

NAR President Chris Polychron says Realtors® are reporting drastic imbalances of supply in relation to demand in many metro areas — especially in the West. “The demand for buying has really heated up this summer, leading to multiple bidders and homes selling at or above asking price. Furthermore, tight inventory conditions are being exacerbated by the fact that some homeowners are hesitant to sell because they’re not optimistic they’ll have adequate time to find an affordable property to move into.”