Investors were treated to the news this month that PayPal Holdings Inc (PYPL) would be spun off from Ebay Inc (EBAY) to create a massive $45 billion stand alone company. The fervor surrounding the successful IPO, alongside a valuation surpassing its parent company, makes for an interesting investment case. While some may choose to own the stock directly, others may be seeking to integrate this theme in their portfolio through a diversified exchange-traded fund.

As both a financial and technology leader, PayPal has revolutionized the way money flows back and forth from individual consumers and businesses. As a result, it’s no surprise that this stock is a top holding in the newly released PureFunds ISE Mobile Payments ETF (IPAY).

IPAY tracks 30 companies engaged in mobile payment options in both digital and electronic formats. This index includes established credit card companies such as Visa Inc (V) alongside financial infrastructure names like Fiserv Inc (FISV). PYPL is a natural fit in this niche technology driven ETF and currently occupies 5.56% of the total portfolio.

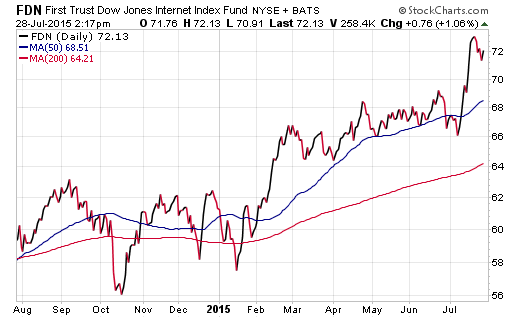

The First Trust Dow Jones Internet Index Fund (FDN) is another fund designed to take advantage of top-tier companies engaged in social media, search engine, and online commerce. EBAY represented a significant holding in FDN prior to the debut of PYPL, and as such this new stock has managed to crack the top 10 holdings. PYPL makes up 3.40% of the FDN portfolio alongside momentum titans such as Amazon Inc (AMZN) and Facebook Inc (FB).

Â

Another index that could ultimately land a large allocation to PYPL is the Guggenheim Spin-Off ETF (CSD). This fund tracks a passive index of 40 U.S.-listed stocks, ADRs, and MLPs that have been spun off from a parent company. Paypal certainly meets the requirements to be included in this exchange-traded fund and will likely be evaluated at a future rebalancing date (typically at the end of each quarter).