I wanted to find which Small Cap stocks had not only the best consistent return in the past year but which ones also had currently not run out of steam. I used Barchart to sort the S&P 600 Small Cap Index stocks first by the Weighted Alpha then looked for stocks with the highest technical buy signals.

Today’s list includes Lending Tree (Nasdaq:TREE), Abiomed (Nasdaq:ABMD), AMN Healthcare Services (NYSE:AHS), Stamps.com (Nasdaq:STMP) and Amedisys (Nasdaq:AMED).

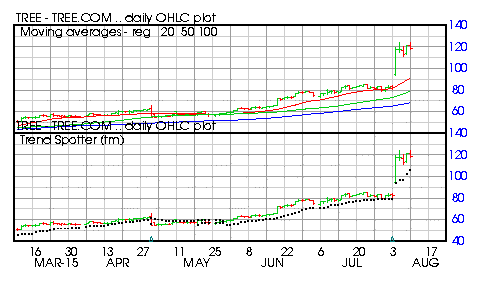

Lending Tree

Barchart technical indicators:

- 96% Barchart technical buy signals

- 248.70+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 52.44% in the last month

- Relative Strength Index 78.12%

- Barchart computes a technical support level at 110.90

- Recently traded at 118.79 with a 50 day moving average of 78.92

Abiomed

Barchart technical indicators:

- 96% Barchart technical buy signals

- 220.00+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 12 new highs and up 42.06% in the last month

- Relative Strength Index 88.45%

- Barchart computes a technical support level 92.00

- Recently traded at 95.96 with a 50 day moving average of 70.40

AMN Healthcare Services

Barchart technical indicators:

- 100% Barchart technical buy signals

- 152.70+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 2 new highs and up 10.23% in the last month

- Relative Strength Index 72.39%

- Barchart computes a technical support level at 33.38

- Recently traded at 34.82 with a 50 day moving average of 30.12

Stamp.Com

Barchart technical indicators:

- 100% Barchart technical buy signals

- 147.60+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 4 new highs and up 14.58% in the last month

- Relative Strength Index 67.47%

- Barchart computes a technical support level at 77.27%

- Recently traded at 83.85 with a 50 day moving average of 72.72