“These comments may give some comfort but it does feel there’s a lot more to come on this story over the weeks ahead.”

That’s from Deutsche Bank’s Jim Reid and the reference is to a “forceful” PBoC press conference held overnight at which China’s central bank attempted to manage expectations after sparking a panic earlier this week with a “surprise” move to devalue the yuan.Â

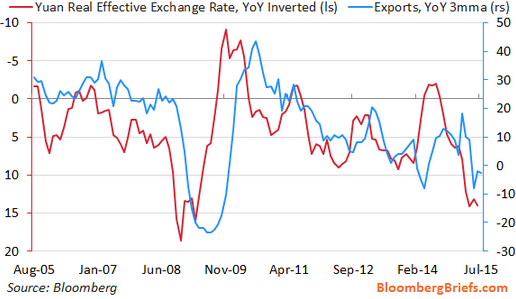

Since then, it’s been carnage in the EM FX markets and every strategist from New York to Beijing has scrambled to figure out the read-through for the Fed in September. What’s fairly obvious to everyone now (and what’s been very clear to us all year), is that China had no choice but to devalue. A string of policy rate cuts hadn’t succeeded in boosting the export-driven economy and keeping the yuan pegged to the strong dollar had led to REER appreciation on the order of 15% in the space of a year.Â

Between the pace of the three-day plunge and rampant accusations that Beijing entered the global currency wars solely to export China’s deflation and prop up the economy, the PBoC had apparently seen enough. Cue an ad hoc presser.

Here’s Goldman with the summary: