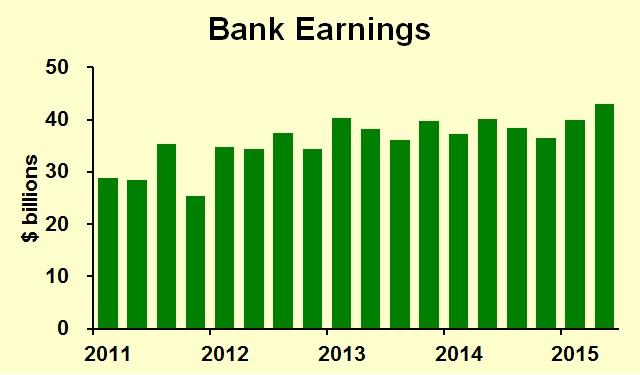

Bank earnings increased in the second quarter, and I expect much better performance in 2016. Bank executives can maximize their gains by focusing on loan growth, monitoring deposit levels, and working on employee retention.

Quarterly earnings were up thanks to most parts of the income statement. Interest income rose 1.6 percent (all comparisons from four quarters previous), thanks to growth of both loans and securities. Interest expense was down in a flat interest rate environment, probably a combination of older CDs maturing and banks being more aggressive in keeping deposit rates down. Non-interest income rose by just under two percent, less than one would expect given overall economic growth (both in volume and price). However, non-interest expense was reduced despite paying more in salaries and benefits.

The big gainers in the past four quarters have been the large regionals. Banks with assets between one and ten billion dollars saw their ROA and ROE grow significantly. The big guys were roughly unchanged from a year ago. The smallest banks, those with less than $100 million in assets, also increased their returns.

The Fed’s interest rate increase will mostly go to net interest margin. In time, deposit rates will increase, but that won’t happen right away. Banks don’t need to compete for deposits, so they’ll pocket higher loan rates without boosting their payouts to depositors. That could boost the net interest margin from about three percent up to four percent, generating a very big pop in earnings.

In 2016 economic growth should continue to help earning assets to rise. The current loan-deposit ratio remains below the long-term average, so it’s all about demand rather than availability of credit. If the economy continues at its recent growth rate, look for about five percent growth of loans. The new loans will be funded by drawing down banks’ accounts at the Federal Reserve, which currently yield a measly quarter of one percent. That will provide a boost to earnings.