Today I used Barchart to find what I think are the 5 best small cap technical buys. I sorted the S&P 600 Small Cap Index stocks first for technical buy signals of 80% or better and then for a Weighted Alpha of 50.00+ or more.

The 5 stocks that made the cut with the highest technical buy signals were CoreSite Realty (NYSE:COR), Universal Insurance Holdings (NYSE:UVE), Bofi Holdings (NASDAQ:BOFI), Digi International (NASDAQ:DGII), Boyd Gaming (NYSE:BYD).

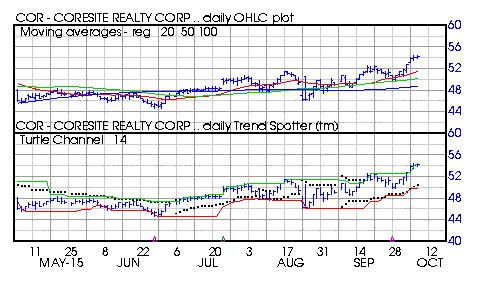

Coresite Realty

Barchart technical indicators:

- 100% BArchart technical buy signals

- 56.00+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 7 new highs and up 9.83% in the last month

- Relative Strength Index 65.59%

- Barchart computes a technical support level at 52.91

- Recently traded at 54.23 with a 50 day moving average of 50.03

Universal Insurance Holdings

Barchart technical indicators:

- 100% Barchart technical buy signals

- 128.40+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 26.58% in the last month

- Barchart computes a technical support level at 30.30

- Recently traded at 32.41 with a 50 day moving average of 27.52

BOFI Holdings

Barchart technical indicators:

- 100% Barchart technical buy signals

- 109.60+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 19.17% in the last month

- Relative Strength index 3.52%

- Barchart computes a technical support level at 131.38

- Recently traded at 136.63 with a 50 day moving average of 123.28

Digi International

Barchart technical indicators:

- 96% Barchart technical buy signals

- 59.40+ Weighted Alpha

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 16.39% in the last month

- Relative Strength Index 67.40%

- Barchart computes a technical support level at 11.63

- Recently traded at 11.66 with a 50 day moving average of 10.40