Every week here in the Safety Net, I take a look at the safety of a stock’s dividend and assign it a rating of “A†through “F.â€

An “A†rating means you can pretty much bank on the dividend being secure. An “F†indicates a cut is either likely or warranted.

But there are times when even if a dividend is not considered safe, it’s not the end of the world. It depends on what your goals are.

For example, this week I’m analyzing KKR (NYSE: KKR), a business development company that invests in other businesses. If you invested in KKR because you needed steady and reliable income, you’ve probably had a nervous breakdown by now.

The company’s quarterly dividend is all over the place. It’s unlike most other businesses. If you invest in McDonald’s (NYSE: MCD), you know that the company is going to sell a certain number of hamburgers and Egg McMuffins every quarter. The likelihood of it selling enough items and turning that revenue into cash flow that will cover a fairly small dividend is very high.

KKR is different in that it returns a lot of what it earns to shareholders. But what it earns can differ greatly from quarter to quarter.

KKR doesn’t sell a product. It invests in companies. And its dividends come from dividends and loan payments from those companies as well as selling positions in them. So if KKR invested in a company early in its development, then later the company goes public and KKR sells its stake, that will be a windfall for shareholders and they will likely see an increased quarterly dividend.

On the other hand, if there are no major exits during a quarter, the dividend will be smaller.

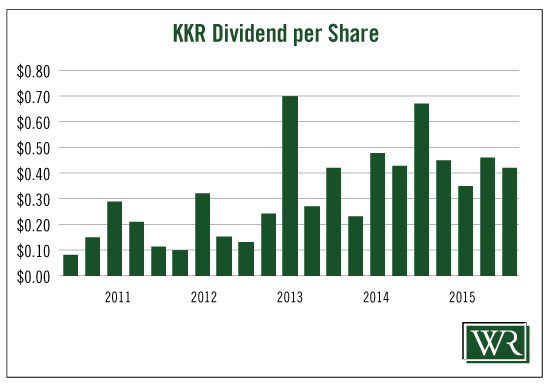

You can see from the chart above just how much the dividend can vary from quarter to quarter. In November 2012, the company paid shareholders $0.24. The next quarter, shareholders received $0.70.

So if you’re an investor who needs to know the quarterly dividend is going to cover certain household expenses, KKR is not the right choice for you because you never know how much the dividend will be.