The non-seasonally adjusted Case-Shiller home price index (20 cities) year-over-year rate of home price growth was 5.5 %. The authors of the index ask whether “the strength seen in home prices since the bottom in 2012 led some to wonder if we’re entering a new bubble“.

- 20 city unadjusted home price rate of growth accelerated 0.3 % month-over-month. [Econintersect uses the change in year-over-year growth from month-to-month to calculate the change in rate of growth]

- CoreLogic currently shows the highest year-over-year growth of 6.4 %.

- The market expected:

| Â | Consensus Range | Consensus | Actual |

| 20-city, SA – M/M | 0.1 % to 0.7 % | 0.3 % | +0.6 % |

| 20-city, NSA – Y/Y | 5.1 % to 5.6 % | 5.3 % | +5.5 % |

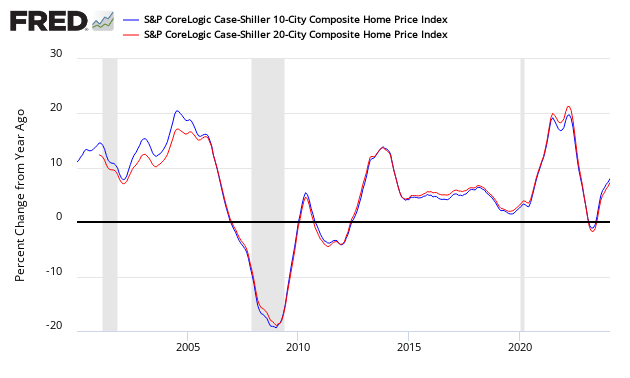

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing all the home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index – and no index is perfect. The National Association of Realtors normally shows exaggerated movements which likely is due to inclusion of more higher value homes.

Comparison of Home Price Indices – Case-Shiller 3 Month Average (blue line, left axis), CoreLogic (green line, left axis) and National Association of Realtors 3 Month Average (red line, right axis)

z existing3.PNG

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth generally appears to be stabilizing (rate of growth not rising or falling).

Year-over-Year Price Change Home Price Indices – Case-Shiller 3 Month Average (blue bar), CoreLogic (yellow bar) and National Association of Realtors 3 Month Average (red bar)

z existing5.PNG

There are some differences between the indices on the rate of “recovery” of home prices.

A synopsis of Authors of the Leading Indices:

Case Shiller’s David M. Blitzer, Chairman of the Index Committee at S&P Indices: