BigTrends.com Weekly Market OutlookÂ

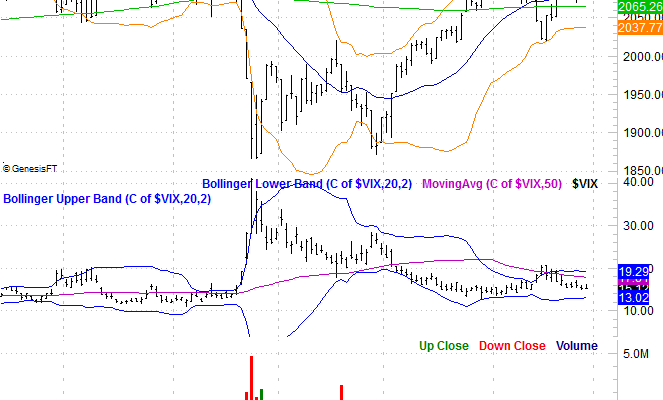

It was a typical Thanksgiving week last week… very quiet. Don’t get used to it though. The market’s activity will perk up again this week as traders get back to their posts. As for which direction that volatility will carry the market, that’s a tougher question to answer. The BigTrends TrendScore for stocks currently rests at 82.7 (out of 100), above 60 means the market is in a bullish trend overall on a Daily/Weekly time basis.

On the flipside, the indexes are very much stuck in the middle of their most meaningful trading ranges right now, and are hugging key short-term moving average lines as floors. We at least have to respect the fact that the market is just one bad day away from at least a small dip that could become a big one.

We’ll weight the upside and downside below, as always. First though, let’s recap last week’s and this week’s most important economic news.

Economic Data

Despite the shortened trading week, last week was pretty full of key economic data… particularly on the real estate and construction front. It wasn’t a terrible month for home sales, but it wasn’t great either. Existing home sales fell from a pace of 5.55 million in September to 5.36 million. New home sales ramped up from 447,000 to 495,000 units, though that fell short of estimates. Either way, the growth trend that had been so impressive through 2014 has wobbled in 2015.

Existing and New Home Sales Chart

Source: Thomas Reuters

Still, home prices continue to ascend. The FHFA Home Price Index as well as the Case-Shiller 20-City Index were both up as of their September reading, suggesting demand remains reasonably firm.

Home Price Chart

Source: Thomas Reuters

Finally, consumer sentiment has been struggling of late, but really hit a wall last month. The Conference Board’s consumer confidence score plunged to a multi-month low of 90.4. The Michigan Sentiment Index edged a little higher for a second month in a row, but is also facing an uphill battle right now. If one or both sentiment readings fall again for this month, that could be a subtle but major headwind for stocks.