2015 has been a most challenging year for investors and thankfully it is coming to a close. Now, it is the time of year that every pundit and forecaster worth their salt offers up a view on what lies ahead in the New Year. Most of these prognostications will mainly be milquetoast projections as Wall Street seers have little incentive to wander far from the consensus. This means an investor will be inundated with projections that the market will gain 5% to 10% in the New Year; pretty much in line with the long term historical averages.

With that in mind, I will offer up some stronger opinions on the key drivers for the market and some picks to successfully profit should these themes play out as predicted in 2016.

Interest Rates:

The Federal Reserve lifted interest rates off of zero in December. It was the first interest rate hike from the central bank since 2006. The institution’s current forecast currently points to four more small hikes in 2016. I would take this forecast with a huge grain of salt. At this time last year, the Federal Reserve’s projections were calling for three interest rate hikes in 2015 and the central bank ended up delivering just the one in the last month of the year.

Given global demand is at the lowest levels since 2009 and both the Japanese and European Central banks are still in an easing mode; it is hard to see more than two interest rate increases in 2016. This is especially true as there is no reason to believe the domestic economy will grow much more than the two percent level it has been stuck in since the weakest post-war recovery on record started back in June of 2009.

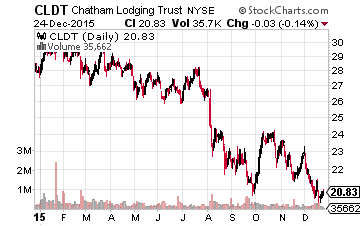

This means there should be some good value in the high yielding real estate investment trust space that has been hit hard leading up to the Fed’s December hike. I personally have added to hotel REIT Chatham Lodging Trust (NASDAQ: CLDT) recently after it staged a significant decline since summer. The company’s FFO (funds from operations) should report a 15% gain in 2016 after a 20% increase in 2015. The stock is cheap at under eight times forward FFO and yields nearly six percent in monthly dividends at current levels.