Gold prices advanced nearly 1.7% on Wednesday to settle at their highest level since November 6. Investors seeking safety from the sharp declines in equities and rising global tensions have been flocking to gold lately. Gold’s gains were helped by a lower dollar and the release of the minutes of the Federal Reserve’s December meeting.

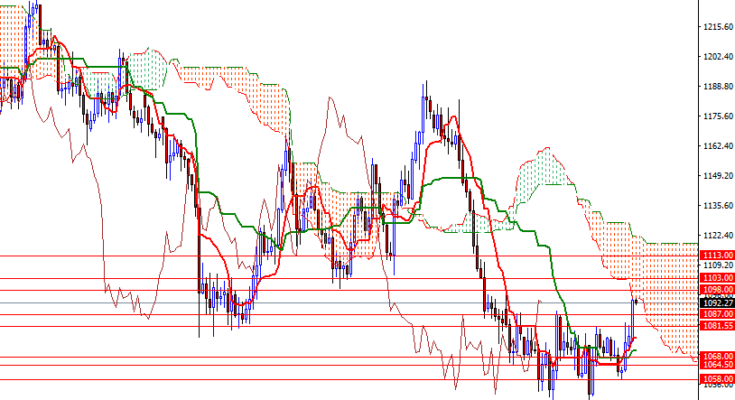

Technical buying pressure was also behind gold’s jump yesterday. Breaking through the 1081.55 resistance triggered a fresh round of buying and pushed prices beyond the 1089/7 region. As I mentioned earlier in the week, positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines on both the daily and 4-hourly charts, along with Chikou Span/Price cross in the same direction level improved the short-term technical picture.

However, the daily Ichimoku cloud stays right on top of us and it occupies the area roughly between the 1094 and 1119 levels. To the upside, there are hurdles such as 1098 and 1103. Ichimoku clouds indicate a good area of support (or resistance as in our case) and when the cloud coincides with a former support/resistance level, they can be quite powerful. In other words, expect some selling pressure in the 1103 – 1098 region. If that is the case, it wouldn’t be surprising to see the XAU/USD pair pulling back to 1089/7. The bears have to drag prices below the 1087 level so that they can have a chance to visit 1081.55. If XAU/USD continues to climb and the 1103 resistance is surpassed, then it is likely that the market will head towards the next barrier at 1113.

Â