Stock of the Week

Stag Industrial (STAG) is a highly-diversified, well-managed, Real Estate Investment Trust (REIT) with a high 7.6% dividend yield. However, it is still a higher risk than many of its industrial REIT peers because of its secondary and tertiary properties, its high growth goals, and its high dividend payout ratio.We believe the company’s biggest risk is macroeconomic in nature, as a significant economic downturn would likely impact Stag more severely than its peers.Additionally, REITs in general face risk from rising interest rates, but they can also add important diversification to a nest egg.Barring a severe economic downturn, we believe Stag’s growing dividend is safe, and we expect the stock to deliver superior total returns.

About Stag:

Stag Industrial is a well-diversified REIT focused on the acquisition and operation of single-tenant industrial properties throughout the United States. The Company owns 281 buildings in 37 states with approximately 52 million rentable square feet, consisting of mostly warehouse/distribution buildings, a variety of light manufacturing buildings and some flex/office buildings (Investor Presentation, p.5).  Stag is more geographically diversified than many of its industrial REIT peers.

Stag’s business model and investment thesis is basically that single tenant properties are often priced too low because of the binary risk of cash flows. Stag believes they can acquire single tenant properties for low prices and then greatly improve the risk profile by holding a diversified portfolio of them (2014 Annual Report, p.5).

Recent Market Performance and Outlook:

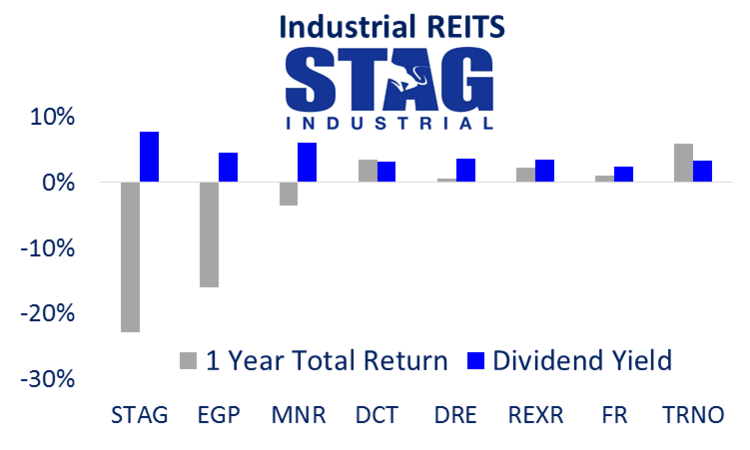

Stag’s dividend yield has recently climbed to an impressive 7.6% as the stock has fallen nearly 30% over the last year. For some perspective, the following table shows the dividend yield and 1-year performance of several of Stag’s Industrial REIT peers:

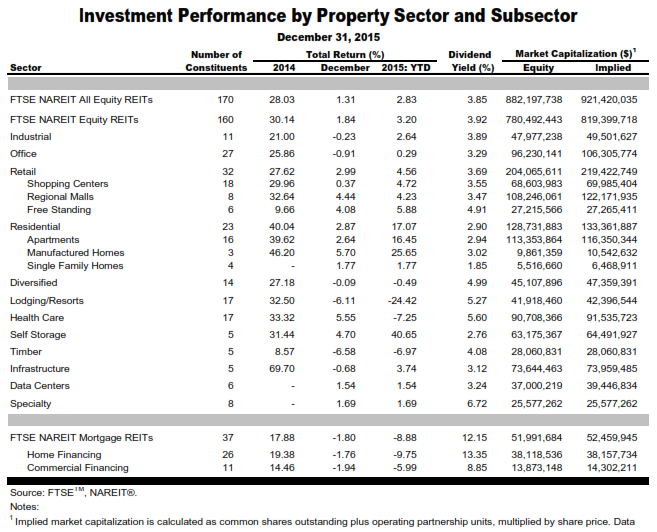

For additional perspective, the following table shows the recent performance of various REIT subsectors:

As the table shows, industrial REITs (such as Stag) have lagged other sub-classes significantly such as residential and self-storage over the last year.However, many real estate professionals believe industrial REITs present an attractive investment opportunity right now.Supporting this notion, is the most recent SIOR Commercial Real Estate Index reading (the SIOR Commercial Real Estate Index (CREI) is an attitudinal survey of local markets completed by commercial real estate market experts (SIOR members)). The survey is conducted quarterly and helps measure the state of the commercial real estate market for the United States). According to the index, market conditions are currently very strong for industrial real estate (values significantly higher than 100 indicate strong market conditions):

Source:Â SIOR