Fear!

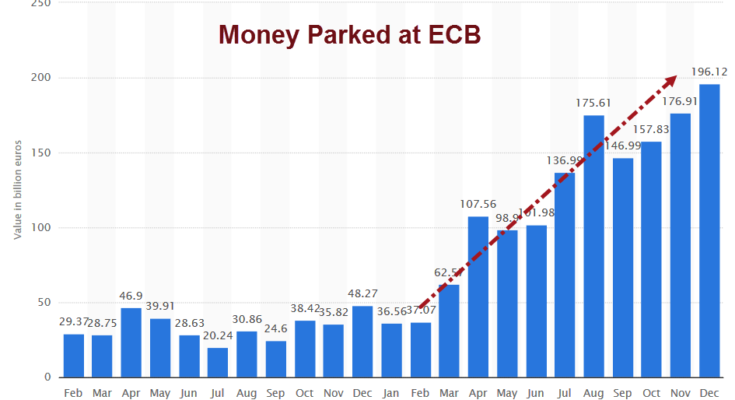

Money parked at the ECB at a negative rate of 0.3% hit a new high at the beginning of 2016.

Above chart from Statista.

Possible Explanations

- Fear of losses elsewhere

- No demand for loans

- No creditworthy borrowers

- Capital impairment at banks

- Failure of ECB policy

To encourage more lending, ECB president Mario Draghi cut the deposit rate for money parked at the ECB from -0.2% to -0.3% on December 3.

Clearly that did not work.

Let’s now take a good look at Target2 imbalances, an excellent measure of capital flight from eurozone countries to other eurozone countries.Â

Target2 Imbalances in Billions of Euros

Â

| Country | Symbol | Target2 Balance | Comment |

|---|---|---|---|

| Spain | ES | -241.8 | Worst Negative Since 2012 |

| Italy | IT | -229.6 | Worst Negative Ever |

| Greece | GR | -97.3 | Least Negative Since 2015 Q1 |

| ECB | ECB | -73.8 | Worst Negative Ever |

| France | FR | -73.5 | Worst Negative Since 2011 |

| Germany | DE | 592.5 | Highest Since 2012 |

| Luxembourg | LU | 140.4 | Highest Ever |

| Netherlands | NL | 49.4 | Highest Since September 2015 |

| Finland | FI | 31.8 | Highest Since August 2015 |

| Cyprus | CY | 2.4 | Second Highest Ever |

I created the above table using data from the ECB Statistical Data Warehouse

European Country Codes

(Click on image to enlarge)

The above from Eurostat Country Codes.

Lack of Trust

Target2 is a measure of capital flight between eurozone countries. For example: A depositor in a Greek, Spanish, or Italian bank does not trust their bank so the depositor opens up a new account and transfers the balance to a bank in Germany, the Netherlands, or Luxembourg instead.Â

The recipient banks then park the money at the ECB at negative interest rates instead ofbuying Greek, Spanish, or Italian bonds. Â