Although most are already fixated on the terrible market performance so far in 2016, companies have yet to report December quarter earnings. This week, investors are waiting to hear how Netflix, Inc. (Nasdaq:NFLX), Bank of America Corp (NYSE:BAC), General Electric Company (NYSE:GE), and Advanced Micro Devices, Inc. (Nasdaq:AMD) finished up 2015. Here is what investors should watch for in the following reports:

Netflix, Inc.

Netflix is set to release its Q4/2015 earnings on Tuesday, January 19 after market close. Analysts are expecting the company to post revenues of $1.83 billion and GAAP earnings per share of $0.02, compared to the same quarter of last year when the company posted revenue of $1.48 billion and EPS of $0.10.

Analysts will be looking for strong U.S. subscription growth figures, as the company posted disappointing growth in the last quarter, which caused shares to take a tumble. Mark Mahaney of RBC Capital is optimistic on subscriber growth levels, pointing to a recent survey that highlighted record usage levels for the company, coming in ahead of YouTube and Amazon (AMZN). The company garnered a lot of positive media attention thanks to several new exclusive series, such as Narcos and Making a Murderer.

Looking forward, international growth will also be in the spotlight as the company announced the international launch of its TV network to over 130 countries, as well as the addition of several new languages, earlier this month. However, these figures will not be reflected in this week’s earnings report.

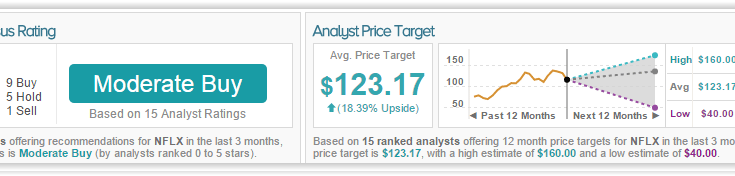

According to TipRanks’ statistics, out of the 15 analysts who have rated the company in the past 3 months, 9 gave a Buy rating, 1 gave a Sell rating, while 5 remain on the sidelines. The average 12-month price target for the stock is $123.17, marking an 18% upside from where shares last closed.

Bank of America Corp

Bank of America will release its Q4/15 earnings on Tuesday, January 19 before market open. Analysts expect the company to post revenue of $19.86 billion and earnings of $0.26 per share, compared to the same quarter of last year in which the company posted revenue of $18.95 billion and EPS of $0.25.