Liberty Property Trust (LPT) is real estate investment trust (REIT) with a big 6.5% dividend yield. However, because the company cut its dividend during the financial crisis (like many other REITs did), and it has not increased its dividend since that cut, Liberty Property receives very little love. We believe this is a REIT worth loving because its dividend is relatively safe, its long-term strategy (to shift out of suburban office properties and into industrial properties) is smart, and it offers a better total return opportunity than many of its peers. Further, we expect LPT may resume dividend increases within the next 12 to 18 months.

History:

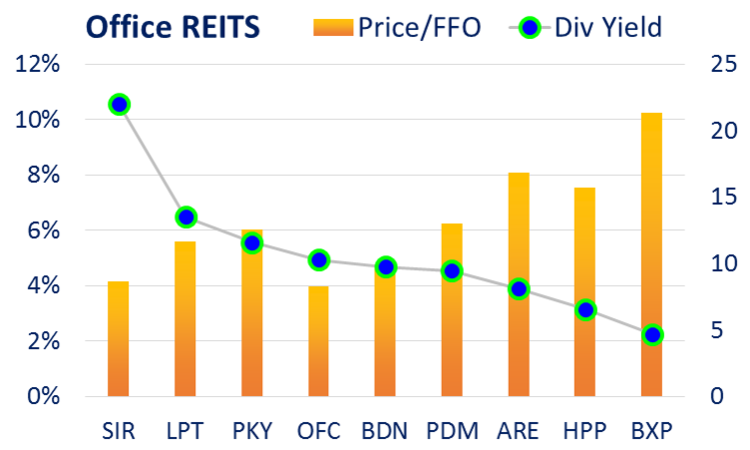

Liberty Property has been developing and managing office and industrial properties since 1972. It became publicly traded in 1994. It currently has 728 industrial and office properties totaling 106 million square feet located mainly throughout the United States. The following chart shows Liberty Property’s high dividend yield relative to some of its peers (the chart also shows price-to-funds-from-operations, more on this later).

Despite Liberty Property’s high dividend yield (as shown in the chart above) it is still unloved by many income investors because it cut its dividend during the financial crisis (like many of its REIT peers) and it has never raised the dividend since then. The following table shows Liberty Property’s historical dividend payments per share.

As the chart shows, Liberty had a nice history of increasing the dividend payment, but that all stopped after it cut its dividend during the financial crisis. The reason Liberty has not increased its dividend in recent years is because of its strategy to change its focus within commercial real estate from suburban office to industrial (and some metro office).

Strategy:

The following graphic shows Liberty’s changing investment strategy in recent years. The company’s focus continues to shift away from less attractive “Suburban Office†properties, to more attractive “Industrial Distribution†properties.Â

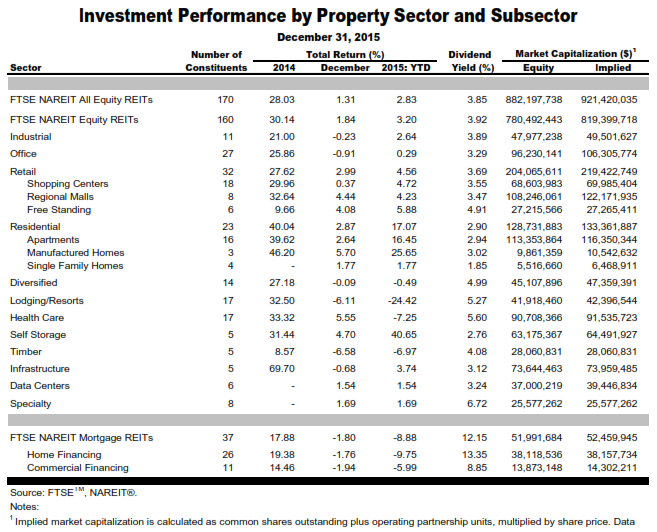

The firm is shifting out of suburban offices because they believe they are less attractive properties in the long-term. They’re not the only ones to believe this as the following table shows recent performance of office versus industrial real estate (as well as a few other categories):

As the table shows, office properties underperformed industrial properties in 2015. Further, many real estate professionals believe industrial real estate presents a more attractive opportunity than office real estate right now. Supporting this notion, is the most recent SIOR Commercial Real Estate Index reading (the SIOR Commercial Real Estate Index (CREI) is an attitudinal survey of local markets completed by commercial real estate market experts (SIOR members)). The survey is conducted quarterly and helps measure the state of the commercial real estate market for the United States). According to the index, market conditions are currently very strong for industrial real estate (values significantly higher than 100 indicate strong market conditions):