A significant issue facing investors is determining whether the world is entering into a global recession. Certainly, economic activity in emerging markets has been challenged due in part to the strength of the U.S. Dollar. Global economies are also dealing with the collapse of energy prices and the negative impact energy weakness is having on the broader industrial sectors as energy capital expenditure cuts ripple through the economy. As noted in our post yesterday, historically, energy prices and equities have a positive correlation, that is, they move in the same direction. Intuitively this makes sense as a stronger global economic environment leads to a higher demand for energy resources. Since late 2013 this correlation broke down and energy prices began to move in the opposite direction of stocks. When January 2016 rolled around though, the correlation between oil and stocks once again turned positive.

Absent ongoing excess supply, weaker energy prices have been one signal the economy is slowing, however, is something different occurring today that is causing this disconnect? We think so and it has to do with too much supply and not a reduction in demand. So back to the recession question. Below are a few economic variables which we believe tilt towards a growing economy, albeit a slow growth one.

Indicators exhibiting a positive trend:

- Jobless Claims

- Consumer Confidence

- Existing Home Sales

- Retail Sales

- Interest Rate Spread (the TED spread)

The three indicators showing weakness:

- Durable Goods Order

- Industrial Production

- ISM Purchasing Managers Index (Manufactures Survey)

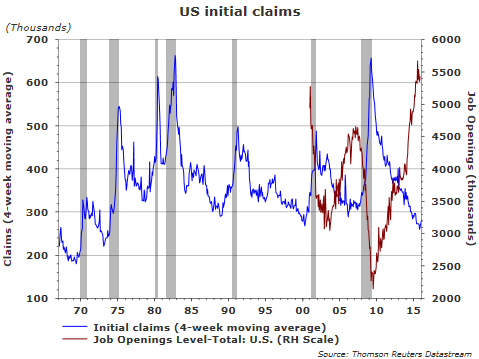

Jobless Claims

- Continued improvement is seen in the 4-week moving average of initial jobless claims with the latest reading reported at 283,000. Additionally, the Job Opening Level (red line) continues to move higher and is far above the level prior to the last recession.

From The Blog of HORAN Capital Advisors

Existing Home Sales