European Bloodbath

A bloodbath that started in Europe quickly spilled over into the US markets today. European bank shares were especially hard hit with Deutsche Bank leading the way.

Deutsche Bank Co-Co bond yields hit 12%. Two-year German government bonds now yield -0.50%.

In the US, yield on the 10-year note sank to 1.74%. US markets are still open, with the S&P 500 down 50 points and the DOW down nearly 400.

Deutsche Bank CoCo Bonds Collapse

A Contingent Convertible Bonds (CoCo) is a debt instrument that is convertible into equity if a pre-specified trigger event occurs. Sometimes these bonds are labeled Enhanced Capital Note (ECN).

CreditSights says Deutsche Bank’s Woes Threaten CoCo Coupons.

Deutsche Bank AG may struggle to pay coupons on its riskiest bonds next year if operating results disappoint or litigation costs are higher than expected, according to analysts at CreditSights Inc.

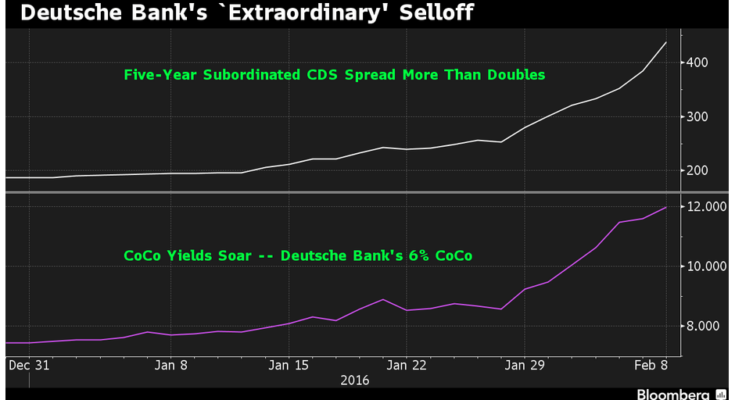

Bonds and stock of Germany’s largest bank have plunged this year, with the shares shedding 39 percent of their value and its contingent convertible bonds — known as CoCos, or additional Tier 1 securities — turning in a similar performance. The cost of protecting the company’s subordinated debt from default for five years using credit-default swaps has more than doubled since the end of 2015, rising to 438 basis points, a four-year high, from 187.

“While we are confident about 2016 coupons, we are less so about coupon payments in 2017,†CreditSights analyst Simon Adamson wrote in a note to clients today. Deutsche Bank will do “everything in its power to pay them†because it will need to issue such bonds in the future, he said.

Deutsche Bank CoCo Yield

Deutsche Bank (DB) Shares Plunge 9%

Shares of Deutsche Bank dropped over 9% today to an new record low price.

German Two-Year Bond Hits Record Low Negative Yield

Negative 0.5% looks damn good compared to across-the-board carnage.