Since January this year, central bankers have tried their best to soothe the markets in a bid to weaken their currencies and boost the equity markets. Mario Draghi was the first to attempt during his ECB press conference. The markets did take heed back then but the rally soon fizzled out. Almost a few weeks later, BoJ’s Kuroda came to the rescue, or so it seemed. While the Yen did indeed weaken, USD/JPY was back to where it was pre-BoJ and even lower.

Today, Janet Yellen takes the spotlight at the semi-annual testimony to Congress and the question is whether Yellen will be successful, where her counterparts have failed?

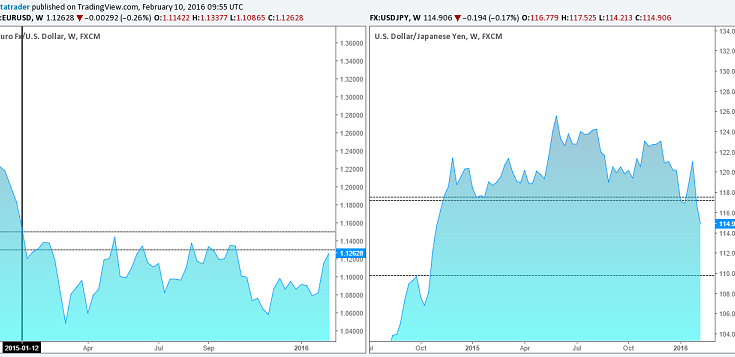

The currencies, with the exception of the US Dollar, are on a bullish run with EUR/USD trading near $1.13 yesterday, which was around the same price level when the ECB launched its QE program in January 2015. The Yen trades at one of the strongest levels seen in a year while Gold’s run saw a quick test to the $1200 handle. Equity markets continue to struggle with the S&P500 way off the 2000 handle with the potential to break even lower.

Â

Â

EUR/USD & USD/JPY Prices

The US Dollar grew weaker after the January’s FOMC meeting showed a dovish picture. USD cross currencies posted one of the sharpest intro week rallies last week as the Euro, British Pound and the Yen continue to keep up the pressure. A good evidence of this was today’s UK manufacturing and industrial production. Soft numbers failed to keep the Pound Sterling subdued as the currency quickly pared its losses to trade just below the 1.45 handle, a key short-term resistance level which looks like it could give way.

Given the market conditions right now and as noted by other Central Bankers, the volatility has indeed moved on from Asia to Europe and even the US. Right now, the probability for a March rate hike remains bleak while some expect the Fed to merely stand by and watch without hiking rates anymore this year. A few go to the extreme ends of speculating that the Fed could look into more QE and potentially introduce negative interest rates as well.