Ahead of the most important macroeconomic event of the week, US nonfarm payrolls (Exp. +200,000, down from 215,000 and following a very poor ADP report two days ago), the markets have that sinking feeling again.

Futures seem unable to shake off what has been a steady grind lower in the past week, while the Nasdaq has been down for nine of the past ten sessions, after yet another session of jawboning by central bankers who this time flipped on the hawkish side, hinting that the market is not prepared for a June rate hike. Additionally, sentiment is showing little sign of improvement due to concerns over global-growth prospects as markets seek to close the worst week since the turmoil at the start of the year.

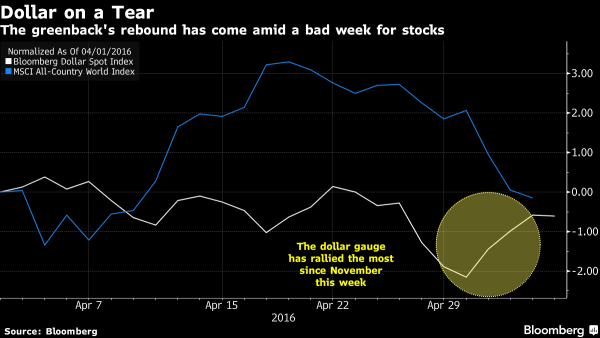

Perhaps its the suddenly ascendent dollars, which has rallied the most since November in the past week, which has not only pushed global markets lower but has resulted in the S&P futures sliding to session lows, down 0.3% as of this moment.

The MSCI World Index extended its biggest weekly decline since February as corporate earnings failed to reassure investors.

“We’ve turned a little bit cautious,†John Woods, chief investment officer for Asia-Pacific at Credit Suisse Private Banking, told Bloomberg TV. “One of the reasons why we’ve gone underweight equities recently is because valuations look stretched at the top of the range but also because the two interest-rate hikes we expect are not being fully priced in by the market.”

Emerging markets headed for the worst week in four months with Turkey, Poland and South Africa providing focal points for selling. U.S. crude oil sank, set for its first weekly drop in more than a month and industrial metals were poised for their biggest weekly loss since 2013 as the aforementined Chinese bubble appears to have finally popped. Bonds and the dollar have been the main beneficiaries, with a gauge of the U.S. currency headed for its best week this year, while German bunds advanced.

“The top worry in the market is still slower growth perspective than feared, and central banks,â€Â said Guillermo Hernandez Sampere, head of trading at MPPM EK in Eppstein, Germany. “We are on thin ice already and we don’t need more disappointments as the Fed is eyeing the job market very closely.â€

As expected, pleas for more central bank handouts were quick: “We expect BOJ to do a U-turn in the coming months by opting for more easing and this is likely to result in renewed yen depreciation,” said Salman Ahmed, the London-based chief global strategist at Lombard Odier Investment Managers, which oversees about $165 billion. “However, we are sometime away from this dynamic to take hold.”

Perhaps the biggest reason for the drift lower is that late yesterday, four regional Federal Reserve presidents said they were open to considering an interest-rate increase in June. After financial markets were roiled in the first six weeks of the year, the central bank had adopted a more dovish stance. Of course, all that will take for these same 4 presidents to change their tune is for stocks to drop lower enough and back to square one we go. Recall how fast the Fed flipflops “With These Two Headlines, Fed “Credibility” Just Hit A New All Time Low.”

As a result, concerns about the Fed and payrolls, have sunk Asian and European markets, with the Stoxx Europe 600 Index falling 0.6 percent as of 11:05 a.m. in London, extending its weekly drop to 3.1 percent. Miners and energy producers posted the worst performance among industry groups, tracking declines in oil prices and base metals. ArcelorMittal (MT) slid 4.9 percent, adding to the gloom as it posted a 33 percent drop in quarterly earnings. Tullow Oil Plc (TUWOY) tumbled 6 percent and Royal Dutch Shell Plc (RDS-A) lost 1.6 percent. Futures on the S&P 500 (SPY) lost 0.3 percent, after the index ended Thursday little changed, as investors awaited the jobs report to shed light on growth in the world’s largest economy and the trajectory of borrowing costs. Traders are pricing in only a 10 percent chance of a Fed interest-rate increase in June, with February 2017 the first month with at least even odds of a raise.

Global Market Snapshot

- S&P 500 futures down 0.3% at 2039

- Stoxx 600 down 0.6% to 330

- FTSE 100 down 0.4% to 6091

- DAX down 0.3% to 9818

- German 10Yr yield down less than 1bp to 0.16%

- Italian 10Yr yield up 2bps to 1.51%

- Spanish 10Yr yield up 2bps to 1.6%

- S&P GSCI Index up 0.2% to 348.3

- MSCI Asia Pacific down 0.5% to 127

- Nikkei 225 down 0.3% to 16107

- Hang Seng down 1.5% to 20142

- Shanghai Composite down 2.8% to 2913

- S&P/ASX 200 up 0.2% to 5292

- US 10-yr yield down than 1bp to 1.74%

- Dollar Index down 0.18% to 93.61

- WTI Crude futures down 0.1% to $44.26

- Brent Futures down 0.2% to $44.93

- Gold spot up 0.3% to $1,281

- Silver spot up 0.1% to $17.37

Top Global News

- Goldman (GS) Said to Extend Fixed-Income Job Cuts to 10% of Staff: Firm is also said to dismiss staff in equities division

- Evonik Said Near $3.5 Billion Acquisition of Air Products Units: Agreement excludes Air Products’ electronics division

- Herbalife Soars After Saying It’s Close to FTC Resolution: Co. expects to pay about $200m in potential settlement

- Credit Suisse (CS) Banker Case Said to Widen With Three New Suspects: Another three former employees as suspects in a case looking into unauthorized trades on the accounts of rich eastern Europeans

- Dish Network Is Said to Be Target of Negative Kerrisdale Report: Report to say Dish’s airwave holdings are overvalued, according to people familiar with the situation

- ArcelorMittal Sees Better Steel Market as Prices Rebound: Co. sees broad recovery in global steel market

- Facebook (FB) Must Face Privacy Claims Over Photo-Tagging Feature: Social network accused of violating Illinois biometrics law

- U.S. Trade Panel to Start Probe on 8 Smartphone Vendors’ Devices

- Teva (TEVA) Said Finalizing Asset Sales to Clear Allergan Deal: Reuters

- Ron Burkle, SBE Said to Near Deal to Buy Morgans Hotel: NYP

- JCPenney (JCP) Said to Take Cost-Cutting Measures: New York Post