Goldman Sachs is cutting back more in its staff than previously announced. Though not yet confirmed, Bloomberg writes that the reductions in the fixed income business are being increased. After posting absolutely horrible results for Q1, the job cuts were expected. The continuation of them, however, seems to be more drastic than first thought even though “market†conditions improved into Q2.

Goldman Sachs Group Inc. is cutting more jobs in its securities units, extending reductions in fixed-income operations this year to roughly 10 percent of workers there, according to people with knowledge of the situation.

The dismissals in New York and London this week build on cuts that already had targeted about 8 percent of fixed-income personnel through last month, people with knowledge of the matter said, asking not to be identified because the plans aren’t public. The push also affects the equities division, one person said.

The article notes that Goldman’s CEO while mindful of the sting of the “bank’s†results is still hungry for opportunity, “looking to grab market share as rivals including Morgan Stanley scale back amid the industrywide slump.†With the firm’s SEC 10-Q now available, it is interesting to see that Goldman reported significantly higher derivatives notionals in Q1 perhaps in opposition to what one might expect given the nature of the funding/trading environment.

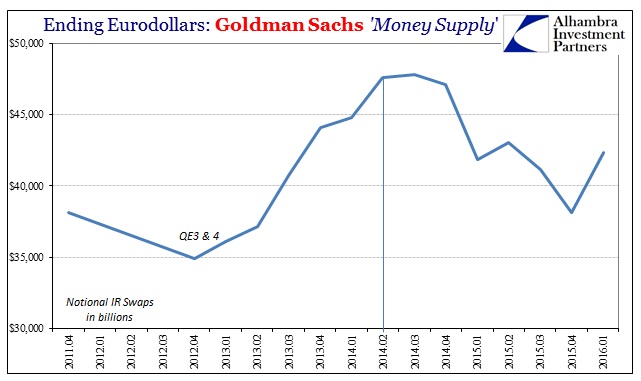

The increase in interest rate swaps was especially notable, rising $4 trillion to the highest level since Q2 last year. It wasn’t just interest rate swaps, however, as the reported balance in credit derivatives also rose. While it wasn’t a huge amount, it was the first increase since the start of 2013 and the initial phase of QE4.

Over at Morgan Stanley, sure enough, that bank’s reported notional balances continued instead their declines. In both interest rate swaps and credit derivatives, MS indicates only that it is steadfastly committed to moving out of the derivatives business. On just this comparison alone, it does seem like despite the job cuts in FICC Goldman might appear to be trying once more for opportunity.