Main Street Capital (MAIN) announced positive first quarter earnings this week, and declared that it will maintain its big monthly dividend payment, currently equal to a 6.9% yield on an annualized basis. And factoring in the company’s semiannual supplemental dividend payments then the yield jumps to over 9%. Valuing the company based on its monthly dividend alone (excluding the semiannual supplemental dividends), Main Street is worth significantly more than its current market price suggests; and if you factor in the possibility of supplemental dividends, the strong internal management team, the diversified risk exposures and the low volatility, then Main Street becomes an extremely attractive option for long-term income-hungry investors.

About Main Street’s Big Dividends

For starters, Main Street’s dividend is large because it has elected to be treated as a Regulated Investment Company (RIC) and a Business Development Company (BDC). This means Main Street generally pays no federal income tax on any ordinary income (or capital gains) that it pays out as dividends to its shareholders. Many other companies retain a significant portion or their earnings for future growth, whereas Main Street has structured its entire business to distribute earnings to shareholders in the form of big dividends.

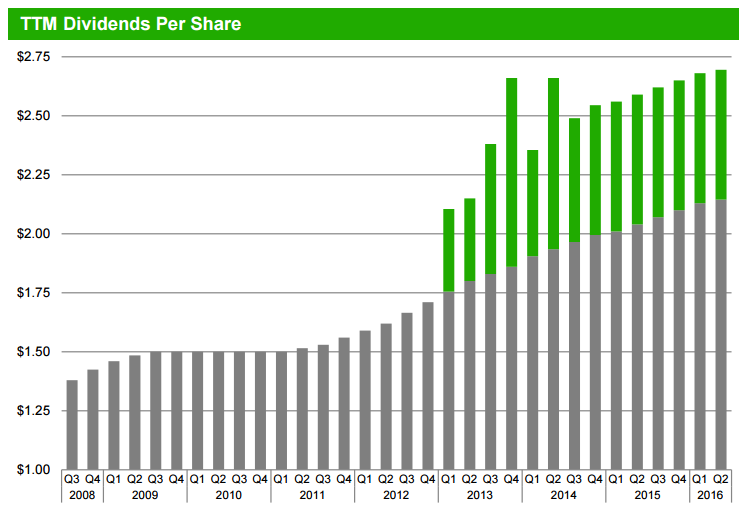

(Source: investor presentation p.20)

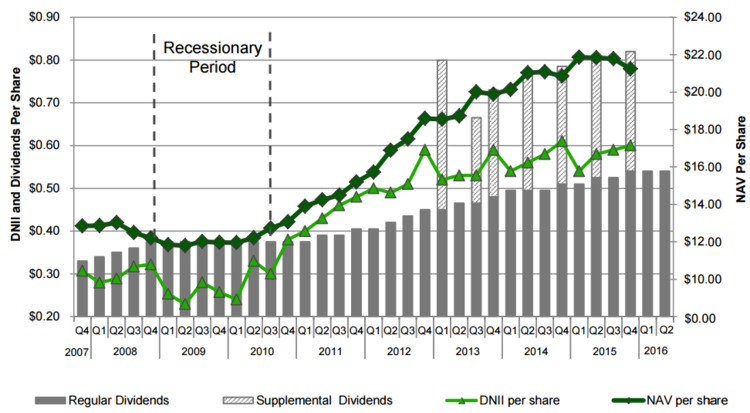

Main Street’s business is focused on providing debt and equity financing to smaller mid-sized companies (companies with revenues between $10 million and $150 million). Subsequently, Main Street funds its monthly dividend payments with cash from secured debt investments, and it funds its supplemental semi-annual dividend payments with realized gains on its equity and debt investments. We believe Main Street’s monthly dividend payments are extremely safe (and its semiannual supplemental dividends are fairly safe), but we’ll dive deeper into the risks later in this report. For reference, the following chart shows Main Street’s historical growth in dividends, distributable net investment income (DNII) and net asset value (NAV).

(source: investor presentation, p.8)

Valuing Main Street’s Big Dividends

Using a basic dividend discount model, and considering only Main Street’s monthly dividends (excluding supplemental dividends for now), Main Street is worth $37.05 per share, or approximately 10% more than its current market price. To arrive at this value we simply discounted the dividend payment ($0.18 X 12) by Main Street’s cost of equity (9.83% using the reasonable assumptions atGuruFocus) minus a conservative 3.5% growth rate (for reference, the six professional analysts survey by Yahoo Finance expect Main to grow by 7% each year for the next five years). And if we add in the supplemental dividends then the same model assigns Main a $41.81 per share valuation, or approximately 38% upside. In our view, Main Capital offers safe dividend payments and plenty of price appreciation potential.