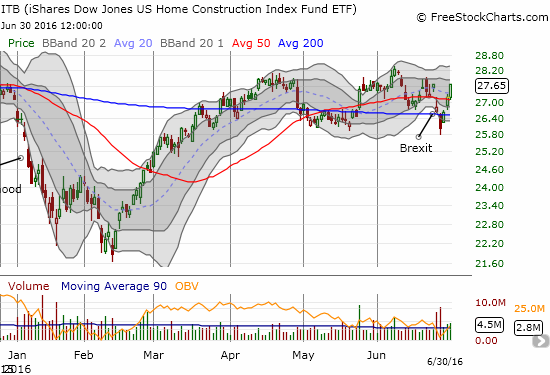

The last Housing Market Review covered data reported in May, 2016 for April. At the time, the iShares US Home Construction ETF (ITB) was experiencing a healthy rebound on the heels of strong data on new home sales. The rally came to a quick halt and had one more small burst in early June. I decided to dip my toe back into the water with some October call options on the iShares US Home Construction (ITB). During the stock market’s brief swoon in the wake of the United Kingdom’s vote to exit the European Union (EU), I did not get a deep enough dip to tease out more purchases.

I cannot shake the feeling that the seasonal trade of home builders is effectively over even if some latent buying interest remains. The net tepid response to the latest round of strong housing data suggests combined with what looks like growing weakness in the West across three of the main metrics I follow seem to confirm that the risk/reward at these levels is tepid. I continue to wait for a larger dip to buy, per my typical strategy for trading the builders.

The iShares US Home Construction (ITB) has recovered all of its post-Brexit losses – time to get back to housing market catalysts.

Source:Â FreeStockCharts.com

New Residential Construction (Housing Starts) – May, 2016

In The last Housing Market Review I expressed relief at an apparent stabilization in housing starts. That stabilization continued in May, consistent with my expectation given strong new home sales in April.

Privately owned housing starts for 1-unit structures came in at 764,000 for May. The April 1-unit starts were revised downward to 762,000 from 778,000. So, the month-over-month change was a gain of 0.3%. The year-over-year growth was a robust 10.1%. The chart below shows the strong uptrend remains in place.

New housing starts stay flat from April to May and maintains the current uptrend.

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis, June 29, 2016.

The West was a big loser for the second month in a row, heightening my on-going wariness about the health of the West’s housing markets. Single unit starts gained 1.9% from April’s big drop, but still lost 4.8% year-over-year. The South registered another double-digit year-over-year gain which was also a 2.6% month-over-month gain. I guess a migration from the West to the South really is happening!?