It’s no secret that Deutsche Bank AG (NYSE:DB) is headed downhill. A look at its plunging stock chart (down 33% as of Q2 2016) – and a quick glance at its Q4 2015 results, which showed a record annual loss of $7.6 billion – confirms what years of shady financial engineering and mounting legal costs have already told us. DB is in serious trouble.

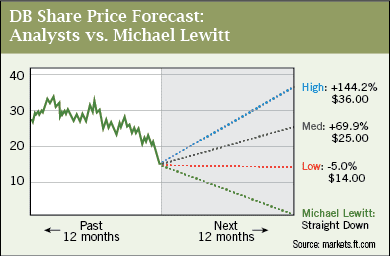

As usual, Wall Street’s “expert†analysts are bullish, advising investors to hold their positions in the company in expectation of a dramatic turnaround.

My own forecast goes straight down – and I’ll tell you why.

Not only is DB a mismanaged and over-leveraged institution, it’s also a ticking time bomb that could set off the worst credit crisis since 2008.

Yes, I’m talking about the Super Crash.

In this special report, I’ll give you an overview of DB’s massive systemic risk and tell you first, how to protect yourself and second, how to profit.

I want you to fully appreciate just how bad this crash could be.

The World Can’t Sustain This Level of Debt for Much Longer

In 2016, the global economy does not possess remotely enough productive capacity to generate the income required to service and/or repay the more than $200 trillion of debt it has already incurred or, for that matter, the incalculable trillions of dollars of future promises governments have made. The United States, which is the best of the bunch, is on an unsustainable economic trajectory and is just a microcosm of the rest of the world. As Figure 2 illustrates, debt has grown much faster than the U.S. economy over recent years.

Furthermore, the gap between the growth rate of debt and the growth rate of the economy is accelerating, which means that the economy can never hope to catch up and generate enough income to pay the interest or the principal on the debt.

Yet alarmingly, the United States is in better shape than the rest of the world.

Debt vs. U.S. economy

In September 2014, the Geneva-based International Centre for Monetary and Banking Studies published a study entitled Deleveraging? What Deleveraging? where it reported that, “[c]ontrary to widely held beliefs, the world has not yet begun to delever and the global debt-to-GDP is still growing, breaking new highs.†Going further, the report’s distinguished authors warned that “in a poisonous combination, world growth and inflation are also lower than previously expected, also – though not only -as a legacy of the past crisis.†Excluding the leverage of financial companies worldwide, debt is now equivalent to 212% of global GDP, up 38% since 2008 (see Fig. 3). Debt is equivalent to roughly 264% of GDP in the U.S., 257% in Europe and 411% in Japan.

Debt vs. global GDP

While debt is rising, global growth is falling. The six-year moving average of the world’s potential growth rate has fallen to below 3% today from about 4.5% before the crisis, no doubt largely due to the much higher level of debt weighing on economies today. When increasing amounts of financial and intellectual capital are devoted to servicing debt, growth is bound to suffer. In effect, the global economy is lugging around on its back a $200 trillion albatross that is suffocating growth. Further, the study’s authors point observe: “Deleveraging and slower nominal growth are in many cases interacting in a vicious loop, with the latter making the deleveraging process harder and the former exacerbating the economic slowdown. Moreover, the global capacity to take on debt has been reduced through the combination of slower expansion in real output and lower inflation.â€

As I’ve pointed out many times before, this level of debt is simply not sustainable – either on a national or a global level. We are suffocating under the weight of massive debt, which we have a rapidly decreasing capability to support.

Just as in 2008, much of this debt problem springs from a single headwater.

Derivatives: “Financial Weapons of Mass Destructionâ€

Warren Buffett’s famous phrase still bears repeating. One of the primary forms that this debt has assumed in the modern economy is the OTC (over-the-counter) derivatives contract….an unregulated, complex nightmare that is not investment, but pure speculation.

As you may have suspected, DB’s systemic risk stems directly from derivatives. In order to understand the gravity of the situation, it’s necessary to go a little deeper.

A derivative is a contract involving two parties that agree to make certain payments to each other. But if one party is unable or unwilling to live up to its agreement and make those payment, the other party is left holding the bag (and nursing a big loss). That’s what happened in 2008.

In 2008, AIG almost blew up because it had written too many derivatives contracts on collateralized bond obligations that held billions of dollars of subprime mortgages. AIG couldn’t meet its obligations, leaving thousands of counterparties around the world at risk of loss. This is why the U.S. government had to step in and bail out AIG – to save those other counterparties from massive losses that would have destroyed the financial system.