The pain for Europe’s banks, and especially those in Italy, continues this morning following the latest news surrounding the Italian bank sector.

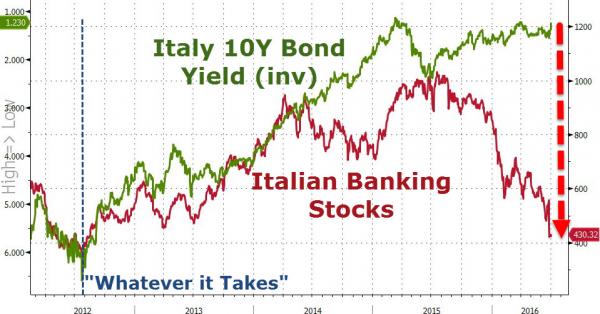

As a reminder, the Euro Stoxx Banks index was down -0.88% last week and is nearly 19% down from its pre-referendum levels. Italian Banks are at the heart of that weakness with the likes of Unicredit, Intesa, Banco Monte dei Paschi and UBI down -9.78%, -3.44%, -15.79% and -6.11% respectively last week, in the process sending Italian stocks to levels not seen since Draghi’s famous “whatever it takes” speech.

As we documented recently, there has been plenty in the press about possible liquidity guarantees and recaps for Italian Banks (not to mention yet another quiet Atlante-funded bailout on Friday) and it looks like this one still has plenty of room to run. Following reports that Italy was planning either a direct €40BN liquidity injection, a plan reportedly shot down by Merkel, as well as an EU cleared proposal for a €150 billion liquidity backstop, last night the FT ran a story suggesting that Italy PM Renzi is prepared to defy Brussels to inject public funds into the banking system should it come under severe systematic stress, and so break the bail-in principles of EU regulation following the upcoming European stress tests which, at least based on Italy’s panicked response, suggest many Italian banks will fail.

That story, however, was denied today when La Repubblica reported that Renzi will respect European Union rules on state aid for banks, an Italian official said on Monday. It remains to be seen he will stick to this commitment especially if the collapse in Italy’s banking sector continues. Overnight DB also said that, “while UK politics has dominated headlines for the last few weeks it feels like the health of Italian Banks could well takeover in the near term.“

Which brings us to the latest catalyst, namely reports that the ECB has asked perpetually troubled, insolvent and repeatedly bailed out Banca Monte dei Paschi di Siena, the world’s oldest bank, to draw up a plan for tackling its bad-loan burden, asking the lender to reduce its load of soured debt to 14.6 billion euros ($16.2 billion) in 2018 from 24.2 billion euros at the end of 2015, Italy’s third-biggest bank said in a statement Monday.