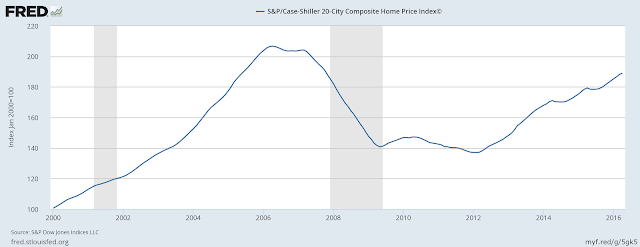

Before ending with ideas offered by market monetarist Marcus Nunes, it is helpful to explain Case-Shiller. The leading indicator of the housing crash was the Case-Shiller Home Price Index, abbreviated C-S HPI. It is a 20-city measurement of house prices. The leading indicator of the housing crash was in serious decline prior to the subprime housing crisis of August 2007. The subprime crash of August was brought into being when the commercial paper market was destroyed, commercial banks were forced to take back loans hidden in SIVs, and subprime loans went away completely.

The banks could have solved at least part of this problem prior to the August crisis, with starter loans for first time buyers, who were either priced out of the market or forced to take subprime mortgages. Starter loans for first time buyers would have been new lifeblood interjected into a housing market where subprime was dying!

If the central bank had 1. encouraged this starter loan program, and 2. had not permitted mark to market, 3. banks would have honored promises to refi toxic loans, and 4. had embarked upon an effort to buy commercial paper in early 2007, the banks would not have stopped lending in the real estate market in general (though the bubble states may have suffered), and the following chart would not have looked the way it now looks.

There may have been a decline in prices, but surely not the decline that took place. After all, the real subprime (including Alt A) debacle came from four states: California, Florida, Nevada and Arizona.

We can see that the crash started before the subprime financial crisis took place. The question is why? The C-S HPI clearly was the leading indicator of crash. The chart is shown below:

Â

The decline in prices began in April, 2007. Again, this was way before the subprime crisis of August, 2007. But the decline was as intense in April as it was after August. The question remains, why?

Clearly, the bankruptcy of New Century Finance must have had a major effect on kick-starting the real estate decline. The trouble started in January of 2007, increased in March, 2007, and culminated in the April 2, 2007 bankruptcy of the firm.