(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 68.95% (was as high as 70.7%)

T2107 Status: 67.3%

VIX Status: 13.5

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #103 over 20%, Day #9 over 30%, Day #8 over 40%, Day #7 over 50%, Day #2 over 60%, Day #21 under 70%

Commentary

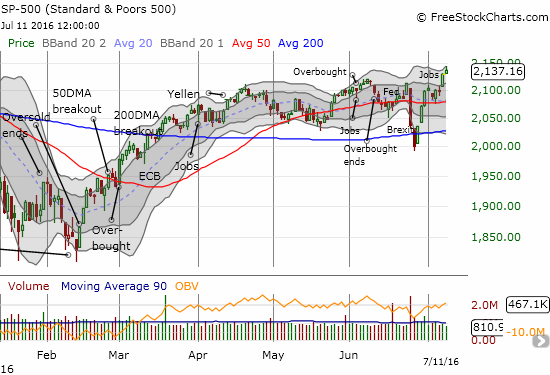

I had my finger poised over the “buy button,†but the market failed to deliver the closing signal. At its high of the day, T2108, the percentage of stocks trading above their 40-day moving averages (DMAs), reached overbought status at 70.7%. A small wave of selling took T2108 down to 68.95%, a close just under the overbought threshold of 70%. The selling took the S&P 500 (SPY)  from a new intraday all-time high of 2143.16 to an all-time closing high of 2137.16.

The S&P 500 breaks out to a new all-time high.

Technically, a new all-time is a very bullish event for the index that should be bought. T2018 tells me otherwise for today. Per T2108, I only flip bullish from bearish in this case once T2108 goes overbought. More importantly, if T2108 fails to break the overbought threshold, I get aggressively bearish on the next notable pullback. Interestingly, the intraday pullback into the close was strong enough to push the volatility index, the VIX, into the green.

The volatility index, the VIX, shows the faintest sign of life for only the second time since Brexit.

Ordinarily, such a small gain in the VIX would barely catch my notice. Here, the VIX is testing its recent lows (yet again), so any sign that the next bounce is about to begin gets me on alert. Needless to say, if the S&P 500 prints a notable pullback from here, I will assume the VIX can at least sustain a bounce back to its 15.35 pivot.