Ford (F) currently offers a big 4.5% dividend yield. And if you factor in the special dividend they paid earlier this year, the yield jumps to 6.4%. However, we believe there are better dividend paying opportunities than Ford because of the significant risk exposures the company faces such as the industry’s wide cyclical swings, Ford’s lack of competitive advantage, its expensive workforce, and its absurd pension assumptions. In this article, we review Ford’s dividend and risk exposures, and then provide details on five big dividend stocks that we like better than Ford.

Ford’s Dividend

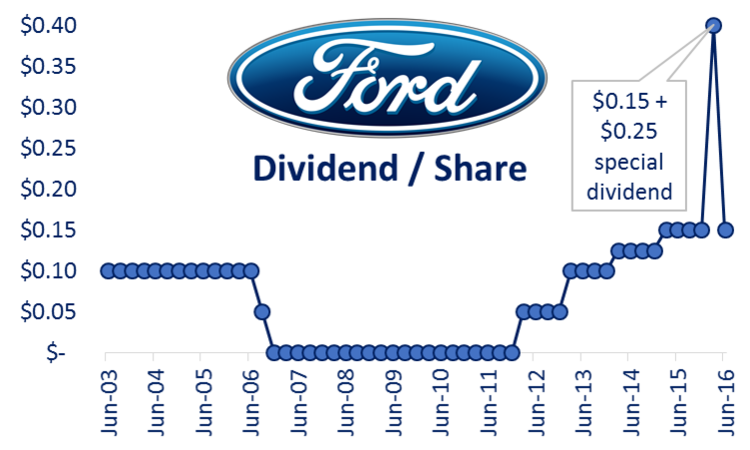

The following chart shows Ford’s historical dividend payments.

The dividend has been increasing steadily since being cut to zero during the financial crisis. And this year’s $0.25 special dividend may become somewhat of a regular occurrence in the future because it gives Ford some flexibility to deal with the industry’s wide cyclical swings (i.e. they can skip the special dividend in challenging years, but still maintain the regular dividend).

The Auto Industry’s Wide Cyclical Swings

By nature, the auto industry is exposed to the risks of wide market swings. For example, we are just coming out of one of the worst where Ford had to cut its dividend to zero (and General Motors relied on a government bailout just to survive). Ford’s beta is over one (1.36 according to Google Finance) which means the stock price has a history of being more sensitive to market-wide swings than average. Specifically, Ford sells autos in North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and any downturns in these markets can stall the company’s growth plans, and there is very little they can do about it. Generally speaking, stocks with higher betas should compensate investors by offering higher long-term returns (assuming the overall market rises), but this may not be the case for Ford considering its lack of competitive advantage.

Ford’s Lack of Competitive Advantage

The auto industry is extremely competitive, and Ford has no significant competitive advantage versus many of its peers. For starters, the high capital costs of manufacturing autos once acted as a barrier to entry, but as efficiencies increase and foreign competition grows, Ford profits are increasingly pressured. Plus, new disruptive technologies (such as autonomous and electric vehicles) continue to put pressure on the company.

Ford has recently been able to increase profitability by increasing operating efficiency (for example, they’ve benefitted significantly from economies of scale by reducing the number of common vehicle manufacturing platforms over the last several years), but this effort can only go so far, and it’s unlikely they’ll be able to grow meaningfully by wrestling market share away from their competitors. For example, Ford’s attempts to grow its higher-margin luxury Lincoln brand could bear some fruit, but realistically not much because competition is already so intense in the industry. Â