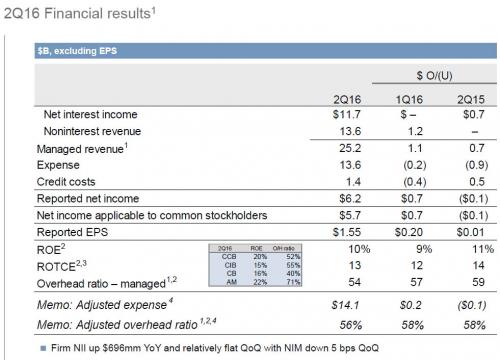

Moments ago, JPMorgan (JPM) – the biggest US bank by assets – became the first bank to report second quarter earnings, which beat expectations with Adjusted EPS of $1.46 (reported EPS of $1.55) on $25.2 billion in non-GAAP revenue ($24.4 billion in reported revenue), which was $1.1 billion higher than in Q1 and $0.7 billion more than a year ago. Wall Street was expecting $1.43 and $24.42 billion in EPS and revenue respectively (although a meet if one uses the actual reported top-line number). Q2 profit fell 1.4%, or less than expected, as fixed-income trading revenue and loan growth jumped.

Net income dropped to $6.2 billion, or $1.55 a share, from $6.29 billion, or $1.54 a share, a year earlier, the New York-based company said Thursday in statement. Revenue climbed 2.8 percent to $25.2 billion. That figure included $3.96 billion from fixed-income trading, a 35 percent increase, and $1.6 billion from equity trading, up 1.5 percent.

While JPMorgan executives have said trading rebounded in April and May, that was before the referendum roiled markets and pushed out expectations for additional U.S. interest-rate increases to at least next year. The delay would extend a post-financial-crisis era of low rates that’s forced banks to rely on expense cuts to cope with stagnant revenue. Citigroup Inc. (C) and Wells Fargo & Co. (WFC) are scheduled to report results Friday, while Bank of America Corp. (BAC), Goldman Sachs Group Inc. (GS) and Morgan Stanley (MS) are due next week. Analysts estimate the industry will post its fourth-straight profit decline in the second quarter, according to data compiled by Bloomberg. The group saw profits fall 12 percent on a year-over-year basis in the first quarter.

Going back to JPM’s results, the good news was that after an abysmal Q1, sales and trading rebounded in the second quarter, in which Jamie Dimon saw “strong underlying performance,†with record consumer deposits, credit card sales volume, merchant processing volume, “broad†core loan growth, particularly in mortgage, commercial real estate.