I evaluated 34 different companies this week to determine whether they are suitable for Defensive Investors, those unwilling to do substantial research, or Enterprising Investors, those who are willing to do such research. We also put each company through the ModernGraham valuation model based on Benjamin Graham’s value investing formulas in order to determine an intrinsic value for each. Out of those 34 companies, only 9 were found to be undervalued or fairly valued and suitable for either Defensive or Enterprising Investors.

The Elite

The following companies were found to be suitable for either the Defensive Investor or Enterprising Investor and undervalued:

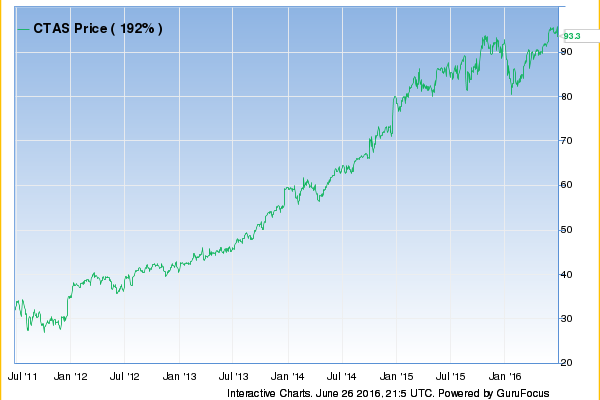

Cintas Corporation (CTAS)

Cintas Corporation is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the low current ratio, high PEmg and PB ratios. The Enterprising Investor is only concerned with the level of debt relative to the net current assets. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $2.07 in 2013 to an estimated $4.36 for 2017. This level of demonstrated earnings growth outpaces the market’s implied estimate of 8.06% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.

Citigroup Inc (C)

Citigroup Inc is suitable for the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor is concerned with the insufficient earnings stability or growth over the last ten years, and the poor dividend history. The Enterprising Investor has no initial concerns. As a result, all Enterprising Investors following the ModernGraham approach should feel comfortable proceeding with the analysis.

As for a valuation, the company appears to be Undervalued after growing its EPSmg (normalized earnings) from $-2.31 in 2012 to an estimated $4.1 for 2016. This level of demonstrated earnings growth outpaces the market’s implied estimate of 1.16% annual earnings growth over the next 7-10 years. As a result, the ModernGraham valuation model, based on Benjamin Graham’s formula, returns an estimate of intrinsic value above the price.